Understanding MEXC Token (MX): A Comprehensive Guide to Investment

What is MEXC Token (MX)?

The MEXC Token, commonly abbreviated as MX, is the native cryptocurrency of the MEXC exchange, a prominent trading platform in the cryptocurrency landscape. Launched in 2018, MX serves as a multi-functional utility token designed to enhance user experience and streamline operations within the MEXC ecosystem. The token is built on robust blockchain technology, enabling fast transactions, security, and transparency, which are essential qualities for users engaging in cryptocurrency trading.

One of the key features that distinguishes MX from other tokens is its governance capability. Holders of the MEXC Token have the opportunity to participate in decision-making processes within the exchange. This means that MX token holders can influence the direction of the platform, including suggestions for new listings, changes in system policies, and more. Such governance features foster a sense of community among users, making it imperative for those looking to invest in MX to understand its implications thoroughly.

In addition to its governance role, the MEXC Token is designed to reduce transaction fees for its users. Those who pay trading fees with MX benefit from a significant discount, incentivizing token adoption. Furthermore, MEXC offers staking opportunities for MX holders, allowing them to earn rewards by locking their tokens in the network. This staking mechanism not only promotes token retention but also enhances liquidity on the exchange.

Overall, the MEXC Token is more than just a utility token; it embodies a system of rewards and governance that promotes active participation in the exchange. By understanding MX, prospective investors can make informed decisions on how to integrate this token into their cryptocurrency portfolios.

How to Invest in MEXC Token (MX)

Investing in the MEXC Token (MX) requires careful planning and execution. First and foremost, prospective investors must create an account on the MEXC exchange. This step typically involves providing basic information, such as an email address and password. Once the account is set up, users may need to complete identity verification to comply with the exchange’s security protocols. This process may include uploading proof of identity and other necessary documents.

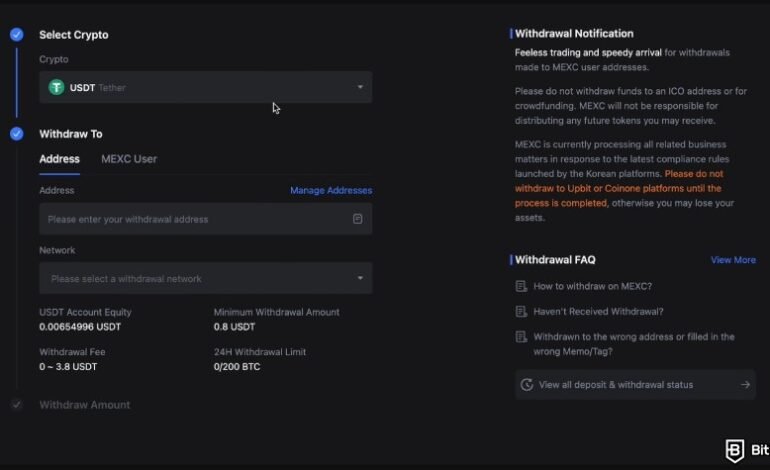

After setting up an account and completing any required verification, the next step is to deposit funds. MEXC offers various payment methods, including bank transfers, credit cards, and cryptocurrencies. Choose the method that suits your preferences, and ensure you understand any associated fees. With funds in your account, investors can proceed to purchase the MEXC Token.

To buy MX tokens, navigate to the trading section of the exchange. It is advisable to choose suitable trading pairs, usually involving stablecoins or established cryptocurrencies like Bitcoin or Ethereum. By selecting the right pair, investors can minimize volatility risks associated with their transactions. When placing an order, consider whether to use market or limit orders; market orders execute instantly at the current price, while limit orders allow for greater control, depending on the pricing goals set by the investor.

New investors should also be aware of common pitfalls. One such risk is overtrading, which can lead to unnecessary losses. Another is falling for FOMO, the “fear of missing out,” which can result in poor investment decisions. Creating a well-defined investment strategy that incorporates research and ongoing education can significantly mitigate risks. By adhering to these strategies and understanding the investment landscape for MEXC, individuals can confidently invest in MX tokens.

Benefits of Investing in MEXC Token (MX)

Investing in MEXC Token (MX) presents a variety of advantages, making it an attractive option for potential investors. The MEXC platform has experienced significant growth and adoption in recent years, contributing to the favorable market conditions surrounding the mx token. As the platform expands its offerings and user base, the demand for MX may increase, suggesting the potential for long-term capital appreciation.

One of the compelling benefits of investing in the MEXC token is the enhanced rewards system designed for token holders. By holding MX tokens, investors often enjoy access to exclusive features on the MEXC exchange, such as reduced trading fees and participation in special sales or listings. Such incentives not only add direct financial benefits for investors but also foster a sense of community among token holders, creating an environment where stakeholders feel valued.

Furthermore, the MX token plays a crucial role in the governance of the MEXC exchange. Token holders are empowered with voting rights on significant decisions impacting the platform’s future, from operational enhancements to new feature integrations. This governance aspect ensures that investors have a say in the direction of the project, fostering a more invested community.

In addition to these aspects, the current market trends and the innovative features of MEXC contribute to a positive outlook. Collaborative efforts with other blockchain projects and continued enhancements to the user experience position MEXC and its associated tokens favorably against competitors. These developments could further enhance the appeal of the mexc token, providing investors reasons to believe in its potential for appreciation.

Overall, the multifaceted benefits associated with investing in MX highlight the token’s promise as a noteworthy asset in the evolving cryptocurrency landscape.

Risks and Considerations When Investing in MX

Investing in the MEXC Token (MX) comes with inherent risks that potential investors must consider. One of the most significant factors influencing the performance of MX is market volatility. Cryptocurrencies, including the MEXC Token, are known for their price fluctuations, which can be influenced by a myriad of factors such as market sentiment, economic news, and the activities of large holders or exchanges. Investors aiming to invest in MX should prepare for the possibility of rapid price changes, which may not always align with their expectations.

Regulatory concerns also loom large over cryptocurrencies. The legal landscape for digital assets continues to evolve, with various governments around the world implementing new regulations that can impact the trading and management of tokens like MX. Investors need to be aware of how regulatory changes may affect their digital asset portfolios, particularly as compliance requirements become stricter. The risk of unexpected changes in regulation should be a crucial factor in the investment decision-making process for those considering acquiring MEXC Token.

Another important aspect is the potential impact of overall market trends. The performance of MX might not only depend on its unique features but also on the crypto market’s general health. Broader trends, such as shifts in investor interest towards other major cryptocurrencies, can influence the price and demand for MEXC Token. Therefore, maintaining a diversified portfolio that includes various assets can mitigate risks associated with market downturns or adverse trends. It is vital for investors to conduct thorough research, staying updated on market movements and overall trends, and to assess their individual risk tolerance before committing to an investment in MX.