How to Buy Gold with Bitcoin in 2025: A Comprehensive Guide

Key Insights:

- Bitcoin (BTC) and gold are widely recognized as valuable investment assets. Combining these can mitigate BTC’s price swings with gold’s steadiness, offering a balanced financial strategy.

- Acquiring gold with BTC requires careful selection of reliable sellers, verifying transaction details, setting up secure wallets, and ensuring accuracy to prevent irreversible mistakes.

- Alternatives like gold-backed ETFs or tokenized gold purchased with BTC provide liquidity, reduced costs, and easier diversification options.

- Tax implications vary globally, and buyers must understand local regulations to manage potential liabilities effectively.

Understanding Bitcoin’s Journey and Role

Bitcoin, introduced in 2009 as a decentralized digital currency, was designed to challenge traditional financial systems. Emerging in the wake of the 2008–2009 financial crisis, BTC has become a revolutionary means of exchange, bypassing intermediaries for direct peer-to-peer transactions. Its ability to operate without borders has made it a cornerstone of financial innovation.

BTC’s value saw its first notable rise in late 2011, starting at a mere $3, and it has since achieved exponential growth. As of December 2024, Bitcoin reached an all-time high exceeding $108,000. This incredible performance has solidified its role as a trustworthy cryptocurrency, especially with the SEC’s classification of most cryptos as securities and the approval of BTC exchange-traded funds (ETFs) in early 2024.

Bitcoin’s adoption as a payment method for physical goods, including gold, highlights its status as a credible medium of exchange. The increasing interest among affluent investors to combine BTC and gold underscores the synergy between these assets in wealth management.

Why Purchase Gold with Bitcoin?

Both BTC and gold serve as valuable assets but with differing strengths. Bitcoin offers high growth potential with significant price volatility, while gold provides stability and has proven its worth across economic cycles. Pairing the two creates a balanced approach to risk and reward in an investment portfolio.

Using BTC to buy gold eliminates the need to convert cryptocurrency into fiat money, reducing transaction costs and enabling faster exchanges. Gold’s historical role as a stable store of value complements BTC’s innovative edge, making this combination a forward-thinking choice for modern investors.

How to Buy Gold with BTC: Step-by-Step Guide

- Choose a Trusted Dealer

Begin by identifying reputable gold sellers who accept BTC. Examine customer reviews, certifications, and the dealer’s inventory, which typically includes gold bars, coins, or rounds. Assess options based on weight, purity, and fees.

- Understand Terms and Conditions

Review the dealer’s policies on pricing, delivery options, and refund terms. Pay close attention to BTC-to-gold conversion rates, which may fluctuate. - Set Up a Bitcoin Wallet

Secure your BTC by using a self-custody wallet like Trust Wallet or a hardware wallet for large holdings. Ensure the wallet you choose supports seamless transactions for gold purchases.

- Make the Payment

Transfer BTC to the seller’s address carefully, double-checking the details to avoid errors. For convenience, consider using QR codes for payments. Retain the transaction ID as proof.

- Secure Delivery or Vault Storage

Decide whether you want physical delivery or secure vault storage. Vaults offer a safe environment for safeguarding valuable assets, while delivery allows you to keep the gold personally.

Gold-Backed ETFs and Tokenized Gold with BTC

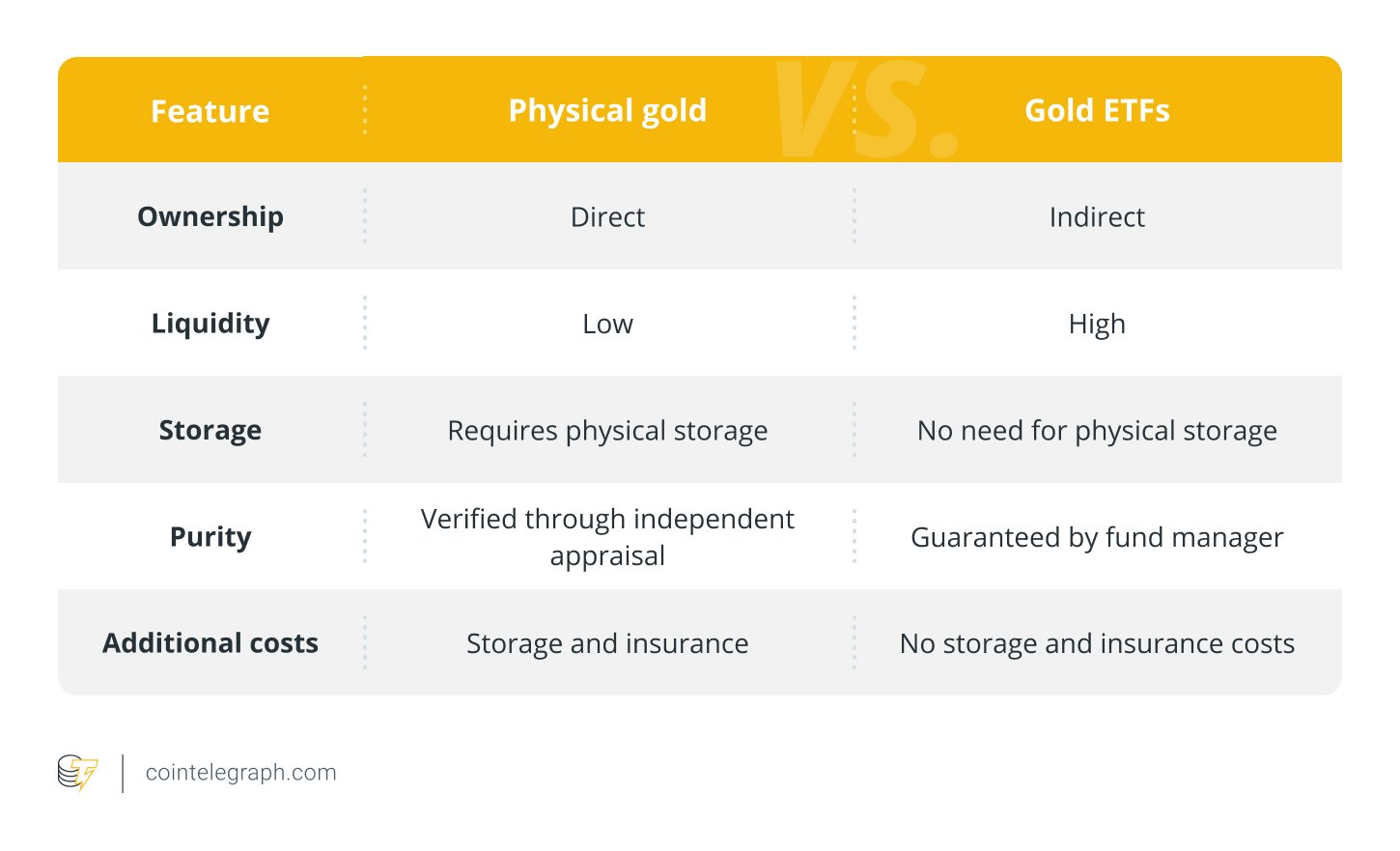

For those who prefer not to hold physical gold, purchasing gold ETFs or tokenized gold with BTC is a convenient alternative. Gold ETFs provide exposure to gold’s value without the need for storage, offering liquidity and ease of trading.

Tokenized gold, represented on blockchains, offers a modern approach to owning gold. Each token corresponds to a specific amount of physical gold, combining gold’s reliability with the efficiency of digital assets. This method allows investors to hedge against cryptocurrency volatility while remaining within the crypto ecosystem.

Tax Considerations and Potential Risks

Using BTC to buy gold often triggers tax obligations, including capital gains taxes in many countries. For example:

- United States: The IRS treats crypto transactions as taxable events.

- UK and Germany: Crypto-to-gold exchanges may incur capital gains or income taxes.

- Singapore: No capital gains tax for individuals but an 8% GST on transaction fees.

Additionally, risks like price volatility, counterparty fraud, and irreversible transactions highlight the importance of selecting reputable vendors and adhering to local regulations.

The Future of Gold and Bitcoin

The combination of Bitcoin and gold offers a powerful blend of modern innovation and timeless stability. By leveraging BTC to invest in gold, forward-thinking investors can craft a well-rounded strategy for wealth preservation and growth in an increasingly digital world.