How the Crypto Market Recovers After a Downturn: Key Factors and Strategies

Discover how the crypto market recovers after a downturn. Learn about the key factors, historical patterns, and strategies to navigate market recoveries.

How the Crypto Market Recovers After a Downturn: Key Factors and Strategies

The cryptocurrency market is known for its volatility, with periods of rapid growth often followed by significant downturns. However, history has shown that the market tends to recover and even thrive after these downturns. In this article, we’ll explore how the crypto market recovers after a downturn, the key factors that drive recovery, and strategies to navigate these periods effectively.

Understanding Market Downturns

Market downturns, often referred to as “crypto winters,” are periods of significant price declines and reduced market activity. These downturns can be triggered by various factors, including regulatory crackdowns, security breaches, macroeconomic conditions, and market sentiment.

Key Factors Driving Market Recovery

Several factors contribute to the recovery of the crypto market after a downturn:

1. Institutional Adoption

Institutional investors play a crucial role in market recovery. Their entry into the market brings increased liquidity, credibility, and stability.

- Example: The 2020-2021 bull run was significantly driven by institutional adoption, with companies like MicroStrategy and Tesla investing heavily in Bitcoin.

2. Technological Advancements

Innovations and upgrades in blockchain technology can boost market confidence and drive recovery.

- Example: Ethereum’s transition to Ethereum 2.0 has been a major factor in its recovery and growth.

3. Regulatory Clarity

Clear and supportive regulations can enhance investor confidence and foster market recovery.

- Example: Countries like Switzerland and Singapore have created favorable regulatory environments, attracting crypto businesses and investors.

4. Market Sentiment

Positive news, media coverage, and community support can shift market sentiment and drive recovery.

- Example: Announcements of major partnerships or technological breakthroughs often lead to price surges.

5. Broader Economic Conditions

Global economic trends, such as inflation and currency devaluation, can drive demand for cryptocurrencies as a hedge against economic uncertainty.

- Example: During periods of high inflation, cryptocurrencies like Bitcoin are often seen as a store of value, driving demand and price recovery.

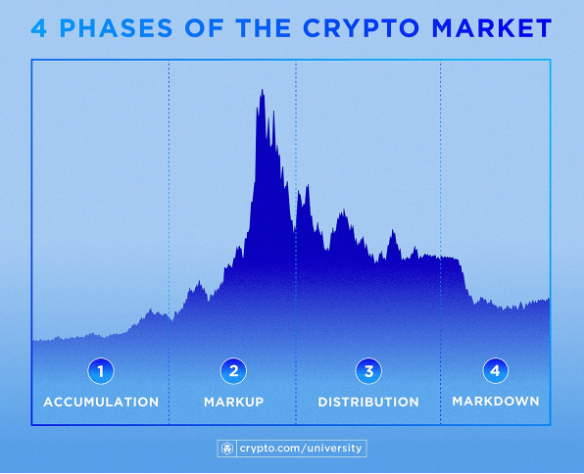

Historical Patterns of Market Recovery

Analyzing historical patterns can provide insights into how the crypto market recovers:

- 2013-2015 Downturn: After the 2013 bull run, the market experienced a significant downturn. Recovery began in 2016, driven by increased adoption and technological advancements.

- 2017-2018 Downturn: Following the 2017 bull run, the market entered a prolonged downturn. Recovery started in 2020, fueled by institutional adoption and macroeconomic factors.

- 2021-2022 Downturn: The market downturn in 2022 was influenced by macroeconomic conditions and regulatory concerns. Recovery is expected to be driven by technological innovations and institutional adoption.

Strategies to Navigate Market Recovery

Here are some strategies to navigate and benefit from market recovery:

- Dollar-Cost Averaging (DCA): Invest a fixed amount at regular intervals, regardless of market conditions, to reduce the impact of volatility.

- Diversification: Spread your investments across different cryptocurrencies and sectors to mitigate risk.

- Stay Informed: Keep up with the latest news, technological developments, and regulatory changes.

- Long-Term Perspective: Focus on long-term growth rather than short-term price fluctuations.

- Risk Management: Use tools like stop-loss orders and portfolio rebalancing to manage risk effectively.

Tips for Investors During Market Recovery

- Avoid Panic Selling: Stay calm and avoid making impulsive decisions based on short-term market movements.

- Research Thoroughly: Conduct thorough research before investing in any cryptocurrency.

- Secure Your Investments: Use secure wallets and enable two-factor authentication (2FA) to protect your assets.

- Engage with the Community: Participate in community discussions and stay informed about market trends.

Conclusion

The crypto market has a history of recovering from downturns and reaching new heights. By understanding the key factors that drive recovery and adopting effective strategies, you can navigate these periods successfully and capitalize on the opportunities they present. Stay informed, remain patient, and focus on long-term growth to achieve your investment goals.