Cryptocurrency Trends 2025: 5 Seismic Shifts Redefining the Digital Asset Landscape

Introduction: The Crypto Market in 2025 is a New Frontier

The year 2025 has ushered in a crypto market that is both exhilarating and fundamentally different from previous cycles. Bitcoin has smashed through previous all-time highs, now trading comfortably above $120,000, while an institutional frenzy propels Ethereum and other major altcoins to new heights. The air is electric with opportunity, but the old playbook of simply buying and holding a few popular coins is no longer sufficient for maximizing returns. Success in this evolved landscape demands a more nuanced approach. We are moving beyond single-asset speculation and into an era of interconnected ecosystems. To truly thrive, investors must master **advanced crypto investment strategies** that recognize the intricate relationships between Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and the next generation of blockchain infrastructure.

This guide will equip you with seven sophisticated strategies designed to navigate this new frontier, helping you move from a passive holder to an active, informed participant in one of the most dynamic financial markets in history.

Strategy 1: Capitalize on the Convergence of DeFi and NFTs

The once-separate worlds of DeFi and NFTs are now colliding, creating a powerful synergy that unlocks new forms of value. This convergence is a cornerstone of many **advanced crypto investment strategies** today, transforming static digital collectibles into productive, yield-generating financial instruments.

Understanding the Symbiosis: When Digital Art Becomes a Financial Asset

In the past, an NFT was primarily a digital bragging right. Today, it’s a key to complex financial interactions. The blockchain technology that proves an NFT’s ownership and authenticity also allows it to be seamlessly integrated into smart contracts. This means your digital art or collectible can now work for you. DeFi protocols recognize the value locked within these unique tokens, allowing them to be used as collateral for loans, staked to earn rewards, or pooled to provide liquidity, generating returns for their owners without requiring a sale.

Actionable Approaches for the DeFi/NFT Investor

- Fractional NFT Investing: High-value NFTs, like CryptoPunks or Bored Apes, are often out of reach for the average investor. Fractionalization protocols break these assets into thousands of fungible tokens, allowing you to buy a piece of a blue-chip NFT. This democratizes access and increases liquidity, offering exposure to high-end digital assets without the multi-million dollar price tag.

- NFT-backed Lending: Platforms like NFTfi allow you to use your NFTs as collateral to borrow stablecoins or other cryptocurrencies. This is a powerful way to unlock liquidity from your digital assets to pursue other investment opportunities without having to sell your prized possessions.

- Liquidity Provision for NFT Marketplaces: Newer NFT exchanges use automated market maker (AMM) models similar to Uniswap. By providing liquidity to an NFT-ETH pool, for example, you can earn a share of the trading fees generated every time someone buys or sells that type of NFT.

Strategy 2: Ride Bitcoin’s Evolution with Layer-2 (L2) Solutions

For years, Bitcoin was seen as digital gold—a secure store of value but with limited functionality. In 2025, that narrative is being rewritten by the emergence of Layer-2 (L2) solutions. These protocols are built on top of the Bitcoin network, aiming to add the scalability and smart contract capabilities that have made Ethereum a DeFi powerhouse. Investing in this evolution is one of the most forward-looking **advanced crypto investment strategies**.

Why Bitcoin is More Than Just Digital Gold in 2025

Bitcoin’s primary limitation has always been its slow transaction speed and inability to natively support complex applications. Layer-2s solve this by processing transactions off the main chain, inheriting Bitcoin’s security while enabling new use cases. This could unlock Bitcoin’s hundreds of billions of dollars in dormant capital, allowing it to be used in DeFi, gaming, and other dApps, fundamentally expanding its utility beyond just a store of value.

How to Identify and Evaluate Promising Bitcoin L2 Projects

As this sector is still nascent, thorough due diligence is critical. Look beyond the hype and evaluate projects like Bitcoin Hyper and others based on core metrics: the robustness of their technology, the experience of the development team, the strength of their growing ecosystem, and their concrete plans for attracting both users and liquidity from the Bitcoin mainnet. The projects that successfully build these bridges will be positioned for exponential growth.

Strategy 3: Master Advanced Yield Farming and Liquidity Provision

Basic staking is a good start, but the real alpha in the 2025 bull run is found in more sophisticated yield-generating activities. Advanced yield farming involves actively managing your capital across multiple blockchains and protocols to capture the highest returns while carefully managing the associated risks.

Graduating from Basic Staking to Multi-Chain Yield Strategies

The crypto ecosystem is no longer dominated by a single chain. High-yield opportunities exist across Ethereum, Solana, Avalanche, and various L2s. An advanced farmer doesn’t just stake ETH on one platform; they might provide liquidity for a newly launched token on Solana, lend stablecoins on an Ethereum L2 like Arbitrum, and simultaneously farm rewards on a Bitcoin L2 protocol. This requires using cross-chain bridges and constantly monitoring the landscape for the best risk-adjusted returns.

Mitigating Risk in High-Yield Environments

Higher yields always come with higher risk. To be successful, you must understand and mitigate these dangers:

- Impermanent Loss: When providing liquidity to a token pair, if the price of one token changes significantly relative to the other, your position can be worth less than if you had simply held the two tokens separately. Understand this concept deeply before becoming a liquidity provider.

- Smart Contract Risk: The code that runs DeFi protocols can have bugs or vulnerabilities. Always invest in protocols that have been audited by reputable security firms and have a proven track record.

- Protocol Longevity: Chasing astronomical yields on brand-new, unaudited protocols is a recipe for disaster. Prioritize established platforms with strong communities and transparent teams.

Strategy 4: Invest in the Tokenization of Real-World Assets (RWAs)

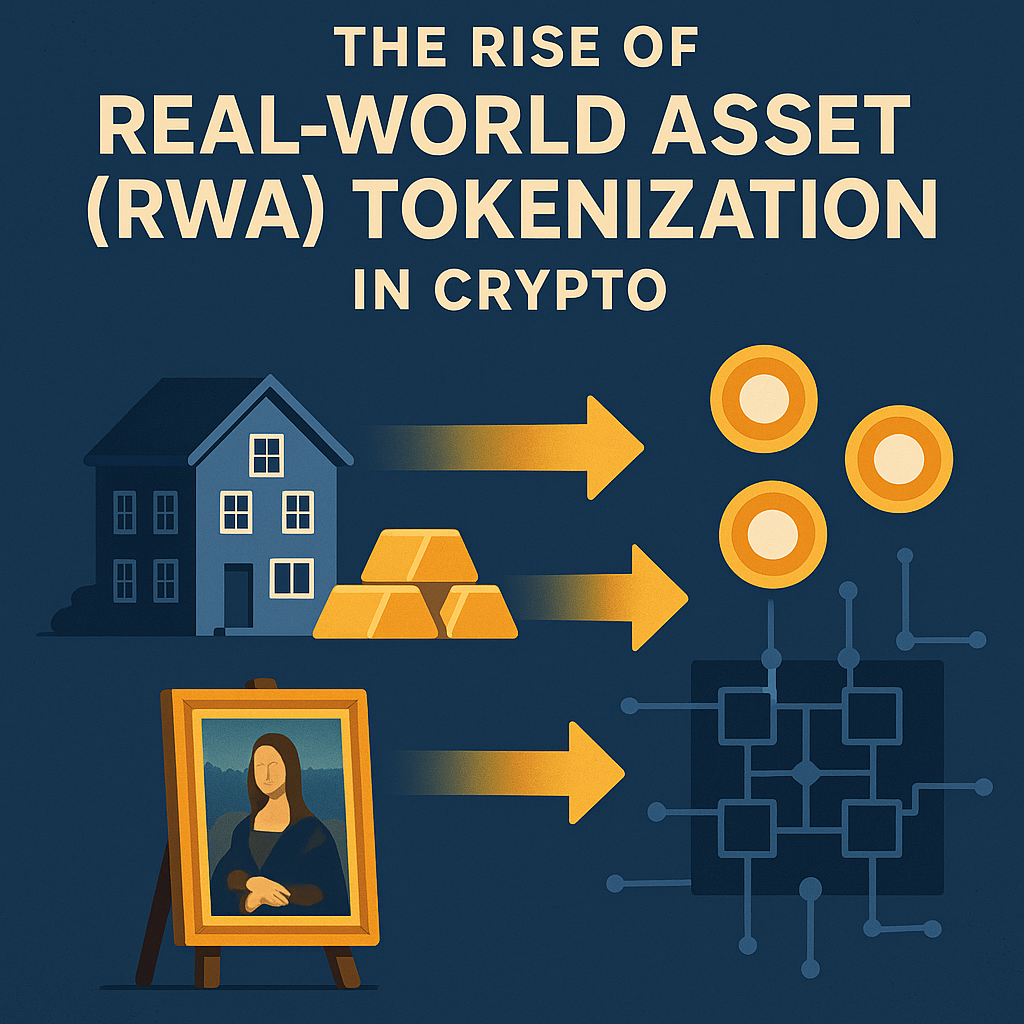

One of the most profound trends of 2025 is the blurring line between traditional finance (TradFi) and DeFi. At the forefront of this movement is the tokenization of Real-World Assets (RWAs), a sector poised to bring trillions of dollars of value onto the blockchain.

What are RWAs and Why Do They Represent a Trillion-Dollar Opportunity?

RWAs are tangible and intangible assets from the off-chain world—such as real estate, private credit, fine art, and government bonds—that are represented as tokens on a blockchain. This process makes traditionally illiquid assets easily tradable, divisible, and accessible to a global pool of investors. For DeFi, RWAs introduce stable, predictable yields backed by real-world cash flows, providing a much-needed counterbalance to the volatility of native crypto assets.

Platforms and Projects Leading the RWA Revolution

Identifying leaders in this space is a key **advanced crypto investment strategy**. Look for platforms like Ondo Finance or Centrifuge that are building the compliant infrastructure needed to bridge the legal and technical gaps between the on-chain and off-chain worlds. These projects are creating the rails for a new financial system, and investing in their native tokens can provide direct exposure to the growth of this burgeoning sector.

Strategy 5: Adopt a Data-Driven Approach to Altcoin Selection

The altcoin market is a minefield of hype and speculation. To navigate it successfully, you need to move beyond social media trends and adopt a rigorous, data-driven framework for analysis. This means looking at the fundamentals that truly drive long-term value.

Beyond the Whitepaper: Advanced Fundamental Analysis

A compelling whitepaper is easy to write; a successful project is hard to build. Your analysis should focus on tangible metrics:

- Tokenomics: Scrutinize the token’s distribution schedule, inflation rate, and utility. Does the token accrue value as the platform grows? Is a large portion held by the team and early investors, posing a future sell-pressure risk?

- Developer Activity: Use tools to track activity on platforms like GitHub. Consistent code commits from a large team of developers are a strong signal of a project that is actively building and improving.

- Genuine Community and Ecosystem Growth: Look for real user adoption, transaction volume, and the number of other projects building on or integrating with the protocol. This is far more valuable than a large but passive social media following.

Using On-Chain Data to Track Smart Money

The blockchain is a transparent ledger. With the right tools, you can track the movements of “smart money”—large whale wallets and institutional funds. Observing which assets these experienced players are accumulating or distributing can provide powerful insights into market sentiment and potential future price movements, giving you an edge over the retail crowd.

Strategy 6: Proactive Portfolio and Risk Management

Building wealth is one part of the equation; preserving it is the other. As your portfolio grows, implementing advanced portfolio and risk management techniques becomes non-negotiable.

The Art of Dynamic Diversification

True diversification in 2025 isn’t just about holding Bitcoin and Ethereum. It’s about diversifying across different sectors of the crypto economy. A well-balanced portfolio might include a core holding of blue-chip assets (BTC, ETH), exposure to promising L1/L2 infrastructure, a basket of DeFi tokens (including RWA-focused ones), and a selection of NFTs or fractionalized NFT tokens. This approach ensures that you are not over-exposed to the failure of any single narrative or sector.

Advanced Security: Protecting a High-Value Portfolio

As your holdings increase, you become a bigger target for hackers and scammers. Basic exchange-level security is insufficient. It is absolutely essential to take control of your assets. This means moving your long-term holdings off exchanges and into your own custody. For any serious investor, learning how to use a cold wallet for safe crypto storage is a fundamental requirement. These hardware wallets keep your private keys completely offline, making them immune to online hacking attempts. For very large portfolios, consider multi-signature setups that require multiple keys to authorize a transaction, providing a corporate-grade level of security.

Strategy 7: Stay Ahead of the Regulatory Curve

The era of crypto operating in a regulatory grey zone is coming to an end. Understanding the evolving global regulatory landscape is a critical, non-technical component of any **advanced crypto investment strategy**.

Interpreting Global Regulatory Signals

Recent developments, such as the passage of comprehensive crypto bills in the US and the SEC’s shifting stance on various assets, have profound implications. Pay close attention to how different jurisdictions are classifying digital assets (e.g., as securities or commodities), the rules being established for stablecoins, and the licensing requirements for exchanges and DeFi protocols. These developments will determine which projects thrive and which face significant headwinds.

Positioning Your Portfolio for Regulatory Clarity

In this environment, it’s wise to allocate a portion of your portfolio to projects that are proactively building with compliance in mind. These projects often engage with regulators, seek appropriate licenses, and design their tokens and platforms to fit within existing or anticipated legal frameworks. While they may not offer the explosive short-term gains of more speculative assets, they represent a safer long-term bet in a market that is rapidly maturing and integrating with the global financial system. For those new to the space, starting with a foundation in a beginner’s guide to crypto can provide the context needed to understand these complex issues.

Conclusion: Synthesizing Your Strategy for Sustainable Growth

The 2025 crypto bull run is not a simple tide that lifts all boats. It’s a complex, multi-faceted market that rewards sophistication, diligence, and foresight. The seven **advanced crypto investment strategies** outlined here provide a framework for moving beyond simplistic speculation and becoming a true digital asset analyst.

By capitalizing on the DeFi/NFT convergence, investing in next-generation infrastructure like Bitcoin L2s, mastering advanced yield techniques, exploring the RWA frontier, and maintaining a disciplined, data-driven approach to risk management and security, you can position yourself to not only survive but thrive. The modern crypto investor is an ecosystem analyst, a technology scout, and a risk manager all in one. Embrace this evolution, and you’ll be well-equipped to navigate the thrilling and rewarding journey ahead in the continued maturation of the digital asset space.