Altcoin Season 2025: Has It Begun? Analyzing Capital Flows & Hot Narratives

While Bitcoin takes a breather, a palpable excitement is rippling through the rest of the crypto market. Billions are shifting, new stories are taking hold, and investors are asking the big question. Is this the real start of the next great **altcoin season 2025**? Let’s dive in.

The Market Backdrop: When the King Stumbles

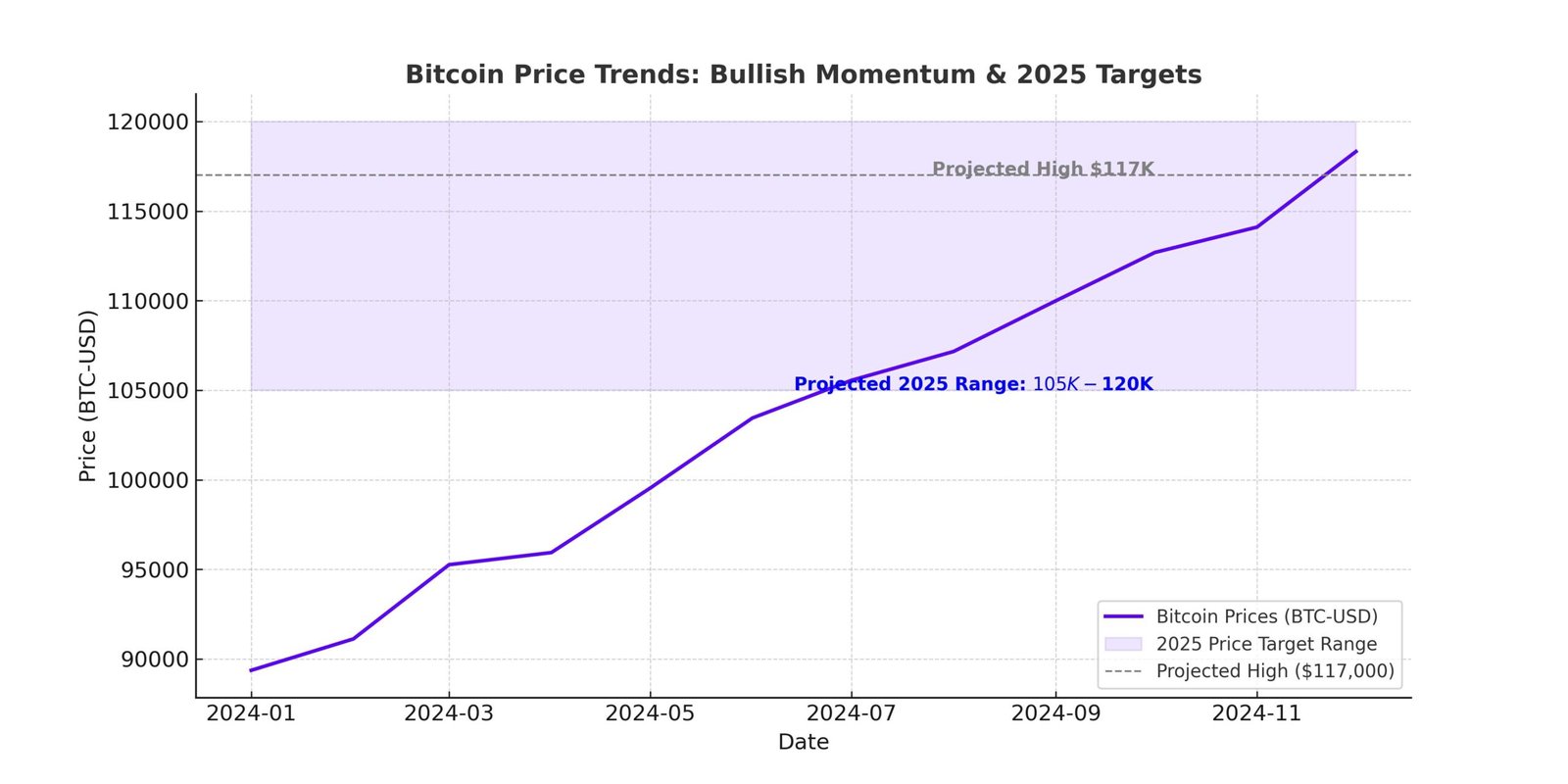

Let’s be honest, the past month has been a bit of a nail-biter for Bitcoin. After a blistering run, August turned into a period of consolidation and correction, and September—historically a tricky month for crypto—is keeping everyone on their toes. BTC seems stuck in a range, unable to decisively break higher.

But while the king of crypto is catching its breath, the rest of the kingdom is buzzing with activity. It feels… different this time. It’s not just random pumps. There’s a narrative shift underway, a calculated rotation of capital that suggests something bigger is brewing. This article will dissect the key signals, explore where the “smart money” is flowing, and weigh the risks to determine if we’re truly on the cusp of a major **altcoin season 2025**.

Signal #1: The Historic Capital Rotation

Perhaps the most telling sign is one you can’t see on a simple price chart: a massive, multi-billion dollar flow of institutional money. In August 2025, we witnessed a historic divergence. While U.S. Bitcoin ETFs saw net outflows of over **$750 million**, Ethereum-based funds attracted an astonishing **nearly $4 billion** in new capital.

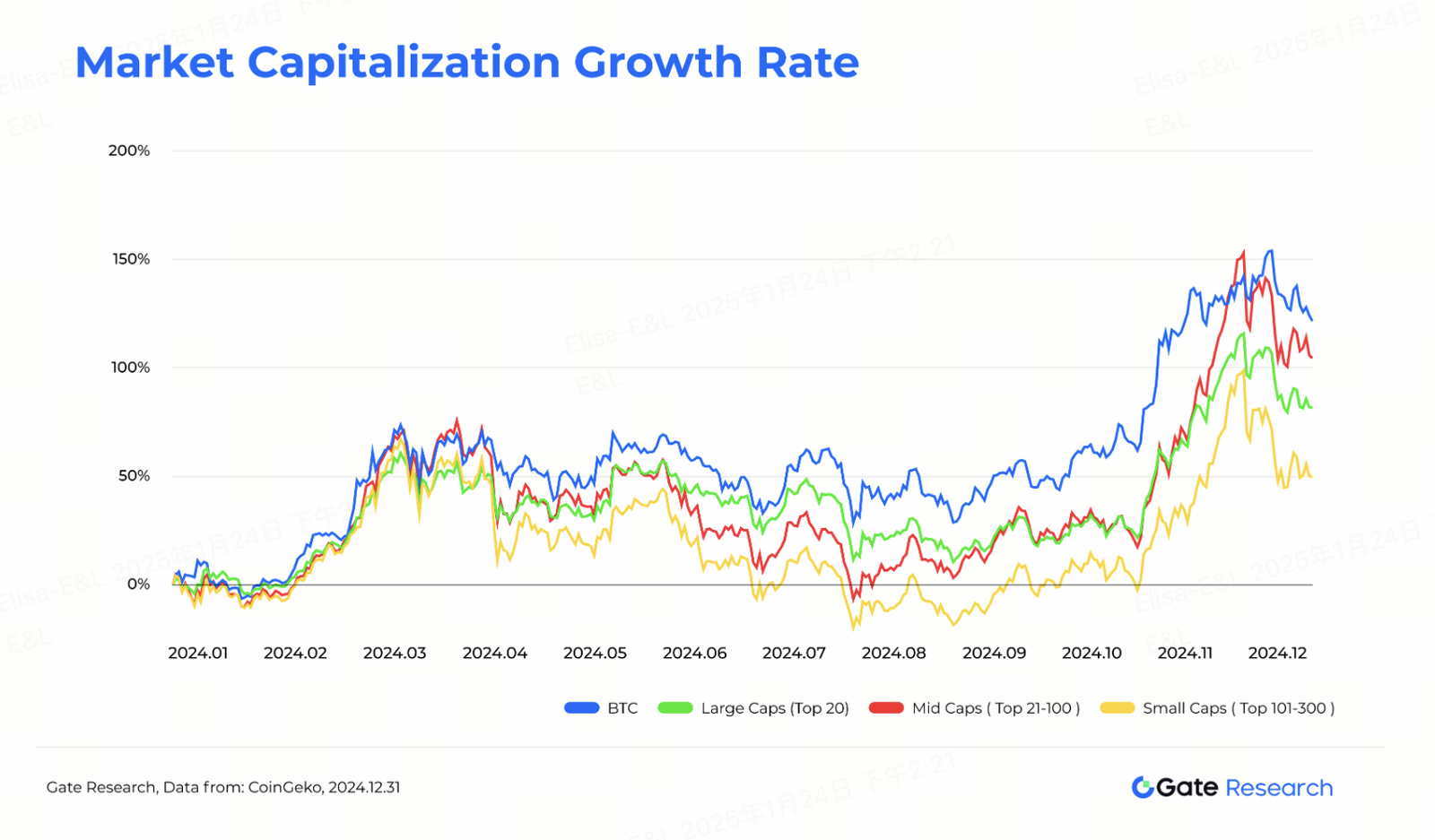

This isn’t pocket change. This is a deliberate, strategic decision by some of the biggest players in finance. They are effectively selling Bitcoin to buy Ethereum. Personally, I see this as a clear vote of confidence in Ethereum’s ecosystem and a signal that institutions are moving further out on the risk curve, beyond the “safety” of Bitcoin, in search of higher growth potential. It’s a classic precursor to a broader market rally led by alternative assets, or what we call an altcoin.

This is reinforced when you look at market dominance charts. Bitcoin Dominance (BTC.D) is struggling, while the total market cap of altcoins is showing strength. The money is undeniably moving, and it’s creating waves across the entire ecosystem.

Signal #2: Where is the Smart Money Pouring In?

So, if capital is flowing out of Bitcoin, where is it going exactly? It’s not just a blind flood; it’s being channeled into specific, high-conviction narratives. These are the stories that are capturing investors’ imaginations—and their dollars.

The Solana Ecosystem Renaissance

Solana is back, and it’s back with a vengeance. The ecosystem is on fire. Memecoins like BONK and WIF have seen explosive growth, often posting double-digit gains while the rest of the market is flat. But it’s more than just memes. Platform projects like Jito (JTO) are showing incredible strength, demonstrating that the interest in Solana is deep and extends to its core infrastructure. The low fees and high speed are once again proving to be a compelling combination for both developers and users, making it a hotbed for potential breakouts during an **altcoin season 2025**.

RWA (Real-World Assets) – The Trillion-Dollar Bridge

This is the narrative I’m personally most excited about. The tokenization of real-world assets is no longer a futuristic dream; it’s happening now. Projects like Ondo Finance (ONDO) are making headlines by bringing tokenized U.S. stocks and other traditional financial products on-chain. This bridges the multi-trillion dollar world of TradFi with the efficiency and accessibility of blockchain. Institutions love this—it’s regulated, it’s tangible, and it represents a massive new market. RWA is a foundational narrative that could provide sustained fuel for the market long-term.

Layer 2s and the DeFi Resurgence

Don’t sleep on the Ethereum Layer 2s! As gas fees on Ethereum’s mainnet stabilize, projects like Optimism (OP) and Arbitrum (ARB) are primed to benefit. They offer a way to interact with the rich Ethereum ecosystem without the high costs. We’re also seeing the emergence of what some are calling DeFi 2.0—new, innovative projects like Berachain with its novel tokenomics, and the rise of BTCFi, which aims to bring DeFi functionality to Bitcoin itself. The world of Decentralized Finance (DeFi) is constantly innovating, creating new opportunities.

Signal #3: The Mood on the Street

Data and narratives are crucial, but you also have to get a feel for the market’s psychology. Right now, there’s a tangible increase in risk appetite. How do we know? Google Trends data shows a spike in searches for terms like “memecoin.” This is a classic indicator that retail investors are re-entering the market, looking for high-risk, high-reward plays.

At the same time, we’re seeing conflicting signals from “whale” wallets. On one hand, there’s evidence of quiet accumulation in certain projects. On the other, there are warnings of significant profit-taking pressure building up. It feels like the market is coiled like a spring, with both greed and fear pulling it in opposite directions. This tension often precedes a major move.

The Reality Check: Don’t FOMO Just Yet

Okay, the case for an **altcoin season 2025** is compelling. But let’s pump the brakes for a second. Investing is never a one-way street, and the risks are very real. Ignoring them would be foolish.

The Shadow of Bitcoin and “Red September”

As we mentioned, September is historically a tough month for Bitcoin. A significant drop in BTC’s price can act like a black hole, sucking the life out of the entire altcoin market, regardless of how strong their individual narratives are. Never underestimate Bitcoin’s gravitational pull.

The Memecoin Minefield

While the explosive gains of memecoins are tempting, this corner of the market is also a minefield. For every token that does a 100x, hundreds more go to zero. Many are outright scams (“rug pulls”) designed to prey on FOMO (Fear Of Missing Out). Tread with extreme caution.

The Token Unlock Tsunami

Another major headwind is the schedule of token unlocks. Reports indicate that hundreds of millions of dollars worth of tokens are set to be unlocked in the coming weeks. This introduces a massive amount of new supply into the market, which can create significant selling pressure and suppress prices.

Conclusion: Your Strategy for Navigating Altcoin Season 2025

So, has it started? All signs point to yes—we are, at the very least, in the opening act of a major market rotation that has all the hallmarks of a budding **altcoin season**. The institutional capital is moving, the narratives are compelling, and retail interest is returning.

However, this doesn’t mean you should go all-in on the first shiny token you see. Success in this environment requires a strategy, not a lottery ticket. Here’s my personal take:

- Diversify Across Narratives: Don’t put all your eggs in one basket. Allocate capital across the key narratives that are gaining traction—RWA, Solana ecosystem, Layer 2s, etc.

- Do Your Own Research (DYOR): This is non-negotiable. Before you invest a single dollar, understand what the project does, who is behind it, and what its tokenomics are. Don’t just buy because someone on Twitter told you to.

- Manage Your Risk: This is the most important rule. Use stop-losses to protect your capital. Take profits along the way. And never invest more than you are willing to lose, especially in more speculative assets.

The next few months could be incredibly exciting and potentially very profitable, but they will also be volatile. The game is afoot. Play it smart.