Trump Media & Crypto.com Deal: CRO Soars on $6.4B Treasury News

Published on August 31, 2025 | Analysis by Neo

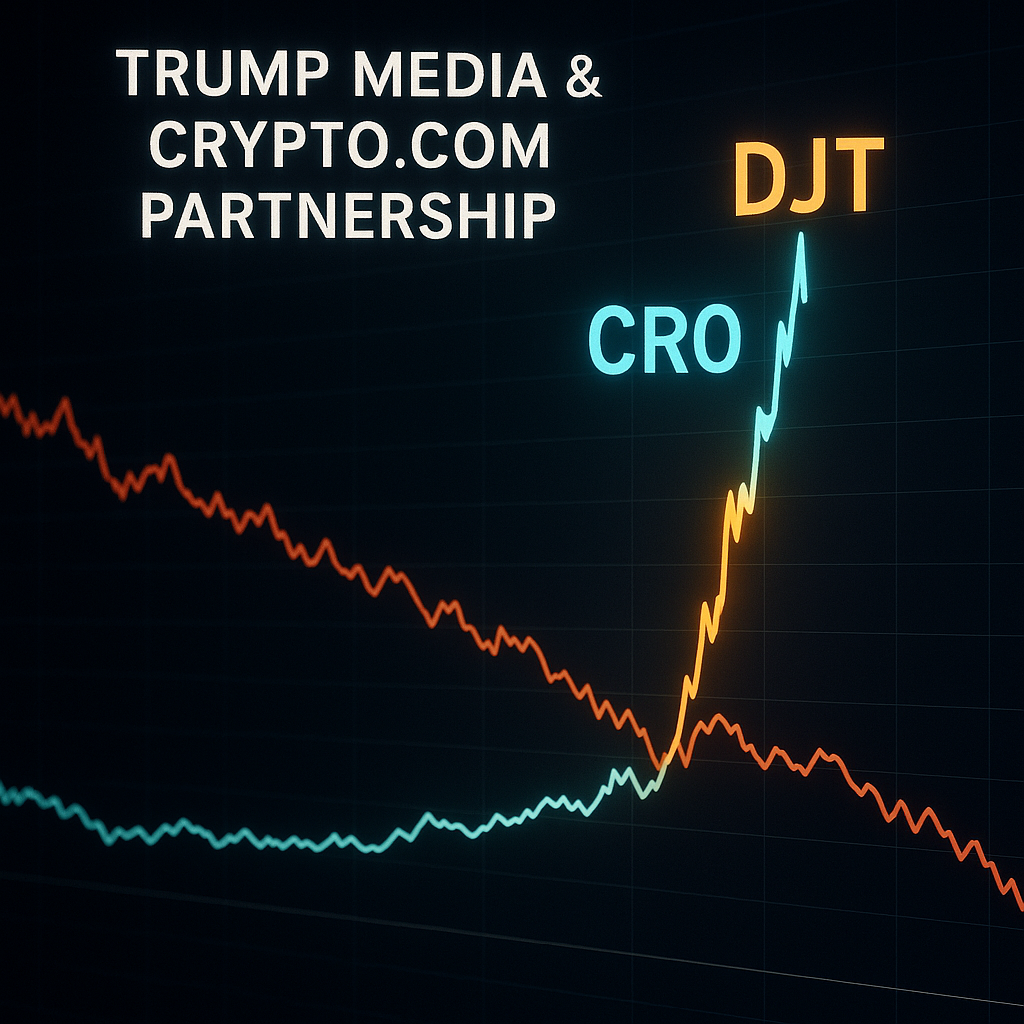

In a market drenched in red, one announcement cut through the noise like a thunderclap. We’re talking about the bombshell news of a **Trump Media Crypto.com partnership**, a strategic alliance aiming to build a colossal $6.4 billion treasury in CRO tokens. Honestly, it’s the kind of story that feels ripped from a speculative fiction novel, but the market’s reaction is all too real. While Bitcoin was busy sliding below $109,000, CRO, the native token of Crypto.com and the Cronos chain, was charting a defiant course upwards. This article dives deep into this historic deal, dissecting its mechanics, market impact, and what it could mean for the future of the entire crypto landscape.

Amidst Market Turmoil, a “Star” is Born: CRO and the Game-Changing Deal

Let’s set the scene. The last week of August 2025 has been brutal for most crypto investors. A sea of red washed over the charts, with Bitcoin itself taking a significant hit, correcting sharply from its recent highs. The general sentiment was leaning towards fear, with many analysts calling for further downside. It felt like another leg down in a prolonged and frustrating consolidation period.

And then, it happened. An official press release dropped, announcing a strategic partnership between Trump Media & Technology Group (TMTG), the parent company of the Truth Social platform, and the global crypto giant Crypto.com. This wasn’t just a simple marketing collaboration. The centerpiece of the deal is a plan for TMTG to build a strategic corporate treasury worth a staggering $6.4 billion, denominated entirely in CRO tokens.

To say this was unexpected would be the understatement of the year. In a single move, CRO was thrust into the global spotlight, not just within the crypto community, but in mainstream financial and political circles. The price action was immediate and ferocious. While the rest of the market licked its wounds, CRO went on an absolute tear, decoupling completely and soaring over 25%. So, the big question on everyone’s mind is: what is actually going on here? Is this a sustainable, fundamental shift or a masterclass in marketing-fueled hype? Let’s break it down.

Deconstructing the “Blockbuster” Deal: What Are Trump Media and Crypto.com Planning?

A partnership of this magnitude is never simple. It’s a complex dance of mutual interests, strategic positioning, and, of course, massive financial commitments. To truly understand its potential, we have to look at what each party brings to the table and what they hope to achieve.

The Official Announcement: Core Terms

According to the joint statement, the core of this alliance is the creation of the $6.4 billion CRO treasury by TMTG. This isn’t just a one-time purchase. The plan involves TMTG acquiring CRO tokens over a multi-year schedule. A key mechanism for this will be the integration of CRO into Truth Social’s upcoming rewards system. Think of it like this: instead of earning points or badges for engagement, users could potentially earn fractions of CRO. This immediately creates a direct pipeline for distributing the token to a large and highly engaged user base. The sheer scale—$6.4 billion—is what’s truly mind-boggling. It represents a significant percentage of CRO’s total supply, signaling a deep, long-term commitment from TMTG.

The Role of Trump Media and Truth Social

So, why would TMTG make such a move? From my perspective, this is a multi-pronged strategic play. First, it’s about user engagement and retention. Integrating a real-world financial asset like CRO into the platform could dramatically increase user activity. It gamifies the experience in a way that goes beyond simple social interactions. Second, it’s a bold step into the Web3 space. For a media company looking to innovate and differentiate itself, embracing cryptocurrency is a powerful narrative. It positions Truth Social not just as a social media platform, but as a gateway to the digital economy. And finally, let’s be honest, it creates a potentially massive new revenue stream and asset on their balance sheet. It’s an aggressive, high-risk, high-reward strategy that perfectly aligns with the Trump brand.

Crypto.com’s Strategic Masterstroke

For Crypto.com, this deal is nothing short of a coup. The primary benefit is obvious: massive user acquisition. The partnership provides a direct on-ramp to the millions of users on Truth Social, a demographic that may not have previously engaged with cryptocurrencies. It’s like opening a new continent for exploration. Furthermore, it dramatically increases the utility of the CRO token. A token’s value is fundamentally tied to its use case. By becoming the backbone of a major social media platform’s rewards system, CRO’s utility skyrockets overnight. This isn’t just a token for trading fees anymore; it’s a token for social engagement. This strengthens the entire Cronos ecosystem and solidifies Crypto.com’s position as a top-tier player in the industry, competing directly with the likes of Binance’s BNB.

The Market’s Instant Reaction: CRO Defies “Winter”

The theoreticals are fascinating, but the market’s reaction was concrete and immediate. The announcement acted like a defibrillator on the price of CRO, shocking it back to life while everything around it was flatlining.

Chart Analysis: The 25% Pump in 24 Hours

Looking at the charts from that day is a stunning visual. You see Bitcoin and Ethereum with long red candles, indicating heavy selling pressure. Then you switch to the CRO chart, and it’s a completely different universe. A massive green candle, backed by an explosion in trading volume not seen in months. The token blew past several key resistance levels as if they weren’t even there. The Relative Strength Index (RSI), a measure of momentum, shot into overbought territory on almost every time frame, indicating a frenzy of buying activity. This wasn’t retail traders FOMO-ing in alone; the volume suggests institutional players were likely scrambling to get a position, anticipating the massive supply sink from TMTG’s treasury purchases.

Social Media Buzz and Investor Sentiment

Crypto Twitter (or X) absolutely erupted. The news was trending globally within an hour. Influencers, analysts, and everyday investors were all weighing in. The sentiment was a mix of sheer disbelief, excitement, and, of course, a healthy dose of skepticism. The term “FOMO” (Fear Of Missing Out) was being thrown around everywhere. People who had written off CRO were suddenly re-evaluating their thesis. The Crypto Fear & Greed Index for the overall market might have been deep in “Fear,” but for CRO, it was an explosion of pure “Greed.” It was a classic example of how a single, powerful narrative can completely override broader market trends, at least in the short term.

The Broader Impact: What Does This Deal Mean for the Entire Crypto Industry?

While the immediate focus is on CRO’s price, I think the long-term implications of this partnership are far more significant. This could be a pivotal moment that reshapes several key narratives within the crypto space.

The “Corporate Treasury” Model with Altcoins: A New Trend?

For years, the gold standard for corporate crypto adoption has been MicroStrategy’s Bitcoin strategy. Michael Saylor pioneered the idea of a public company holding Bitcoin as its primary treasury reserve asset. But this **Trump Media Crypto.com partnership** introduces a new, potentially revolutionary model: building a corporate treasury with a utility-rich altcoin. Is this the start of a new trend? Will we see other large corporations partner with Layer-1 or Layer-2 ecosystems to build treasuries in tokens like SOL, AVAX, or MATIC? It’s a compelling thought. While Bitcoin is digital gold (a store of value), tokens like CRO are more akin to equity in a digital nation-state, offering both potential appreciation and deep integration possibilities.

The Intersection of Politics and Cryptocurrency

This deal also represents one of the most significant crossovers between mainstream U.S. politics and cryptocurrency to date. Regardless of one’s political views, the Trump brand is undeniably one of the most powerful and recognized in the world. Its explicit embrace of a specific cryptocurrency token could serve as a major “legitimization” event for a huge segment of the population that has so far been skeptical or unaware of digital assets. It moves crypto out of the purely tech and finance domains and places it squarely in the middle of a cultural and political conversation. This could accelerate adoption, but it also comes with its own set of risks.

Potential Risks: The “Double-Edged Sword”

And we have to talk about those risks. This is a double-edged sword, no doubt. Tying a token’s fate so closely to a politically-linked entity means CRO’s value could become susceptible to political volatility. News cycles, elections, and regulatory stances related to Donald Trump could now directly impact CRO’s price. Furthermore, a deal this high-profile is guaranteed to attract intense scrutiny from regulators like the SEC. They will be looking very closely at the nature of the partnership, the token’s classification, and the marketing around it. Finally, there’s the sustainability risk. Is this partnership built on a foundation of genuine, long-term value creation, or is it a brilliant marketing ploy designed to generate short-term hype? The success of the integration into Truth Social will be the ultimate litmus test.

Looking to the Future: What’s the Outlook for CRO and What Are the Lessons for Investors?

With the initial shockwave now settling, investors are trying to figure out what comes next. Is this the start of a parabolic run for CRO, or is a “sell the news” event looming?

CRO Price Forecast: Is the Rally Sustainable?

In the long run, the sustainability of this rally depends entirely on execution. If TMTG and Crypto.com deliver on their promises—if the CRO treasury is steadily acquired and the Truth Social integration is seamless and popular—then the fundamental value of CRO has undeniably increased. This would create a consistent buying pressure and a massive token sink, which are powerful drivers for price appreciation. However, the path there will be volatile. Short-term traders will look to take profits, and any negative news or delays in the rollout could lead to sharp corrections. The base case, in my opinion, is that CRO has established a new, higher trading range. The ultimate ceiling depends on factors that are now intertwined with both the tech and political worlds.

Lessons for the Retail Investor

For the average investor, an event like this is a crucial learning opportunity. The first lesson is simple: don’t chase parabolic pumps. Jumping in after a 25% green candle is often a recipe for getting burned. The second lesson is the age-old wisdom of “Do Your Own Research” (DYOR). It’s crucial to look beyond the headline and understand the mechanics, the risks, and the long-term vision. Ask yourself: do you believe in the long-term success of this integration? Finally, this highlights the importance of risk management. For those who choose to invest, it’s wise to consider it a high-risk play and allocate capital accordingly. Never go all-in on a single news event, no matter how exciting it seems.

Conclusion: A Historic Milestone or a Fleeting “Bubble”?

So, where does that leave us? To be completely frank, the **Trump Media Crypto.com partnership** is one of the most fascinating and unpredictable events to happen in the crypto space in years. It’s a potent cocktail of media, politics, and decentralized finance that defies easy categorization.

On one hand, it represents a landmark moment for crypto adoption, a new model for corporate treasuries, and a massive fundamental boost for the Cronos ecosystem. On the other, it introduces new layers of political and regulatory risk and raises questions about long-term sustainability versus short-term hype.

The only certainty is that this story is far from over. The coming months will be critical as we watch for further details on the treasury acquisition and the Truth Social integration. Whether this becomes a case study in visionary strategy or a cautionary tale of hype-driven mania, one thing is clear: the worlds of traditional power and decentralized finance have just collided in a spectacular way, and the aftershocks will be felt for a long time to come. The future will tell if this was a foundation for a new era or just a beautiful, fleeting bubble.