Risks of Investing in the Crypto Market: What You Need to Know

Discover the key risks of investing in the crypto market. Learn about volatility, security threats, regulatory challenges, and how to mitigate these risks.

Risks of Investing in the Crypto Market: What You Need to Know

The cryptocurrency market offers immense opportunities for investors, but it also comes with significant risks. Understanding these risks is crucial for making informed investment decisions and protecting your assets. In this article, we’ll explore the key risks associated with investing in the crypto market and provide tips on how to mitigate them.

1. Market Volatility

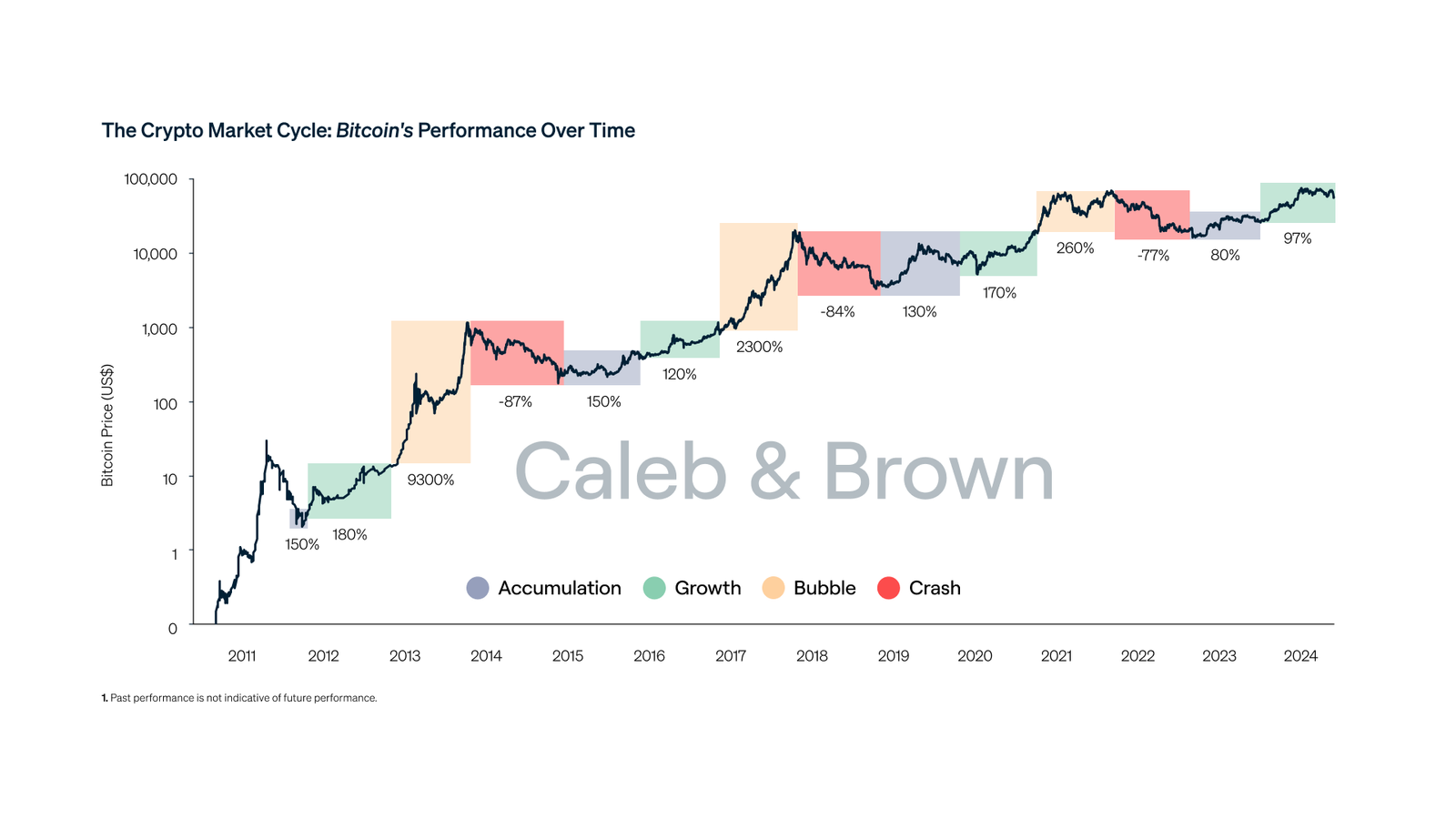

Cryptocurrencies are known for their extreme price volatility. Prices can swing dramatically within short periods, leading to significant gains or losses.

- Impact: High volatility can result in substantial financial losses and emotional stress.

- Mitigation: Adopt a long-term investment strategy and avoid making impulsive decisions based on short-term price movements.

2. Security Threats

The decentralized nature of cryptocurrencies makes them a target for hackers and cybercriminals.

- Common Threats:

- Hacking of exchanges and wallets.

- Phishing attacks and scams.

- Smart contract vulnerabilities.

- Impact: Loss of funds and personal information.

- Mitigation: Use secure wallets, enable two-factor authentication (2FA), and avoid sharing private keys.

3. Regulatory Risks

The regulatory environment for cryptocurrencies is still evolving, leading to uncertainty and potential legal challenges.

- Common Issues:

- Changing regulations and compliance requirements.

- Bans or restrictions in certain jurisdictions.

- Tax implications and reporting requirements.

- Impact: Legal and financial consequences, including fines and asset seizures.

- Mitigation: Stay informed about regulatory developments and consult legal experts if necessary.

4. Liquidity Risks

Some cryptocurrencies may have low trading volumes, making it difficult to buy or sell large amounts without affecting the price.

- Impact: Difficulty in executing trades and potential price slippage.

- Mitigation: Invest in cryptocurrencies with high liquidity and trading volumes.

5. Technological Risks

The technology underlying cryptocurrencies is still developing and may have vulnerabilities.

- Common Issues:

- Bugs and flaws in blockchain protocols.

- Network congestion and scalability issues.

- Forks and chain splits.

- Impact: Loss of funds, network downtime, and reduced user confidence.

- Mitigation: Invest in projects with strong technical foundations and active development teams.

6. Market Manipulation

The crypto market is susceptible to manipulation due to its relatively small size and lack of regulation.

- Common Tactics:

- Pump and dump schemes.

- Wash trading and spoofing.

- Insider trading.

- Impact: Artificial price inflation and potential losses for unsuspecting investors.

- Mitigation: Conduct thorough research and avoid investing in highly speculative projects.

7. Scams and Fraud

The crypto market is rife with scams and fraudulent schemes designed to deceive investors.

- Common Scams:

- Fake ICOs and IDOs.

- Ponzi and pyramid schemes.

- Phishing and social engineering attacks.

- Impact: Loss of funds and personal information.

- Mitigation: Verify the legitimacy of projects and platforms before investing.

8. Operational Risks

Operational issues can arise from the management and execution of crypto-related activities.

- Common Issues:

- Exchange hacks and technical failures.

- Loss of access to wallets and private keys.

- Errors in transactions and smart contracts.

- Impact: Loss of funds and operational disruptions.

- Mitigation: Use reputable platforms, back up your private keys, and double-check transaction details.

Tips for Mitigating Crypto Investment Risks

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies and sectors to reduce risk.

- Stay Informed: Keep up with the latest news, trends, and developments in the crypto space.

- Use Secure Wallets: Store your cryptocurrencies in secure wallets, preferably hardware wallets.

- Enable Security Features: Use two-factor authentication (2FA) and strong passwords to protect your accounts.

- Conduct Thorough Research: Research projects thoroughly before investing and avoid making decisions based on hype.

Conclusion

Investing in the crypto market offers significant opportunities but also comes with substantial risks. By understanding these risks and adopting effective mitigation strategies, you can navigate the crypto market more safely and make informed investment decisions. Stay informed, prioritize security, and approach investments with caution to protect your assets and achieve your financial goals.