How to Research and Identify Promising Crypto Projects: A Comprehensive Guide

Learn how to research and identify promising crypto projects with this comprehensive guide. Discover tips, tools, and best practices for evaluating potential investments.

How to Research and Identify Promising Crypto Projects: A Comprehensive Guide

The cryptocurrency market is filled with thousands of projects, each claiming to offer unique solutions and high returns. However, not all projects are created equal. To make informed investment decisions, it’s crucial to know how to research and identify promising crypto projects. In this guide, we’ll walk you through the steps to evaluate crypto projects effectively, helping you uncover hidden gems and avoid potential scams.

Step 1: Understand the Basics

Before diving into research, it’s essential to understand the basics of blockchain technology and cryptocurrencies. Key concepts to familiarize yourself with include:

- Blockchain: A decentralized ledger that records transactions across a network of computers.

- Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code.

- Tokens and Coins: Digital assets that represent value or utility within a blockchain ecosystem.

Step 2: Define Your Investment Goals

Clearly define your investment goals to guide your research process. Consider the following questions:

- What is your investment horizon? (e.g., short-term, long-term)

- What is your risk tolerance? (e.g., conservative, moderate, aggressive)

- What are your financial goals? (e.g., wealth accumulation, passive income)

Step 3: Conduct Thorough Research

Thorough research is the cornerstone of identifying promising crypto projects. Here’s how to approach it:

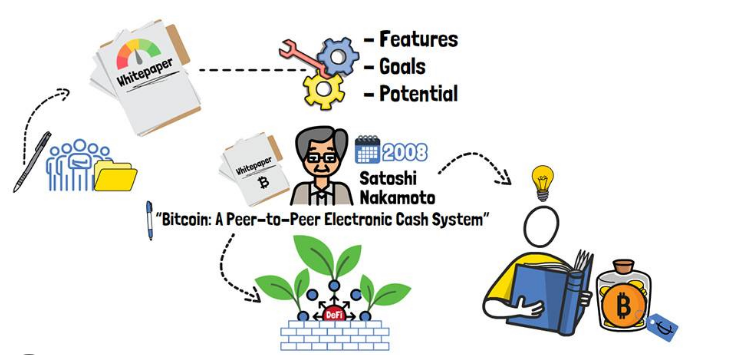

1. Analyze the Whitepaper

The whitepaper is a project’s foundational document, outlining its goals, technology, and roadmap.

- Key Elements to Look For:

- Problem statement and solution.

- Technical details and innovation.

- Tokenomics (token distribution, utility, and economics).

- Roadmap and milestones.

2. Evaluate the Team

The team behind a project plays a crucial role in its success.

- Key Factors to Consider:

- Team members’ backgrounds and experience.

- Previous projects and achievements.

- Transparency and credibility.

3. Assess the Technology

The technology underpinning a project is a critical factor in its potential success.

- Key Aspects to Evaluate:

- Scalability and performance.

- Security measures.

- Interoperability with other blockchains.

4. Examine the Community and Ecosystem

A strong community and ecosystem are indicators of a project’s viability.

- Key Indicators:

- Active community engagement (e.g., social media, forums).

- Partnerships and collaborations.

- Developer activity and contributions.

Step 4: Use Research Tools and Resources

Several tools and resources can aid your research process:

- Blockchain Explorers: Tools like Etherscan and Blockchair allow you to explore blockchain transactions and addresses.

- Crypto News Websites: Stay updated with the latest news and trends on platforms like CoinDesk, Cointelegraph, and Decrypt.

- Community Forums: Engage with the crypto community on platforms like Reddit, Bitcointalk, and Telegram.

- Portfolio Trackers: Use tools like Delta or Blockfolio to monitor your investments and track project performance.

Step 5: Evaluate Market Potential

Assessing the market potential of a crypto project is crucial for identifying its long-term viability.

- Key Factors to Consider:

- Market size and growth potential.

- Competitive landscape.

- Real-world use cases and adoption.

Step 6: Monitor Regulatory Environment

Regulatory developments can significantly impact the success of a crypto project.

- Key Considerations:

- Compliance with local and international regulations.

- Legal challenges and risks.

- Regulatory support and clarity.

Step 7: Stay Informed and Adapt

The crypto market is constantly evolving, and staying informed is essential for making informed decisions.

- Key Practices:

- Follow industry news and updates.

- Participate in community discussions.

- Continuously update your knowledge and adapt your strategy as needed.

Tips for Identifying Promising Crypto Projects

- Diversify Your Research: Look into multiple projects and compare their strengths and weaknesses.

- Avoid Hype: Be cautious of projects that rely heavily on marketing hype without substantial technological backing.

- Check for Transparency: Transparent projects with clear communication and regular updates are more likely to succeed.

- Consider Long-Term Potential: Focus on projects with strong fundamentals and long-term growth potential.

Common Mistakes to Avoid

- Ignoring Research: Failing to conduct thorough research can lead to poor investment decisions.

- Overinvesting: Avoid putting all your funds into a single project.

- Neglecting Security: Ensure you use secure wallets and platforms to protect your investments.

- Following the Crowd: Avoid making investment decisions based solely on popular opinion or trends.

Conclusion

Researching and identifying promising crypto projects requires a combination of thorough analysis, critical thinking, and continuous learning. By following the steps outlined in this guide, you can make informed investment decisions and uncover projects with significant potential. Remember to stay informed, diversify your portfolio, and prioritize security to navigate the crypto market successfully.