Factors Influencing the Value of Cryptocurrencies: A Comprehensive Analysis

Discover the key factors that influence the value of cryptocurrencies. Learn about market dynamics, technological developments, and external influences that impact crypto prices.

Factors Influencing the Value of Cryptocurrencies: A Comprehensive Analysis

The value of cryptocurrencies is influenced by a wide range of factors, from market demand to technological advancements. Understanding these factors can help you make informed investment decisions and navigate the volatile crypto market. In this article, we’ll explore the key elements that impact the value of cryptocurrencies.

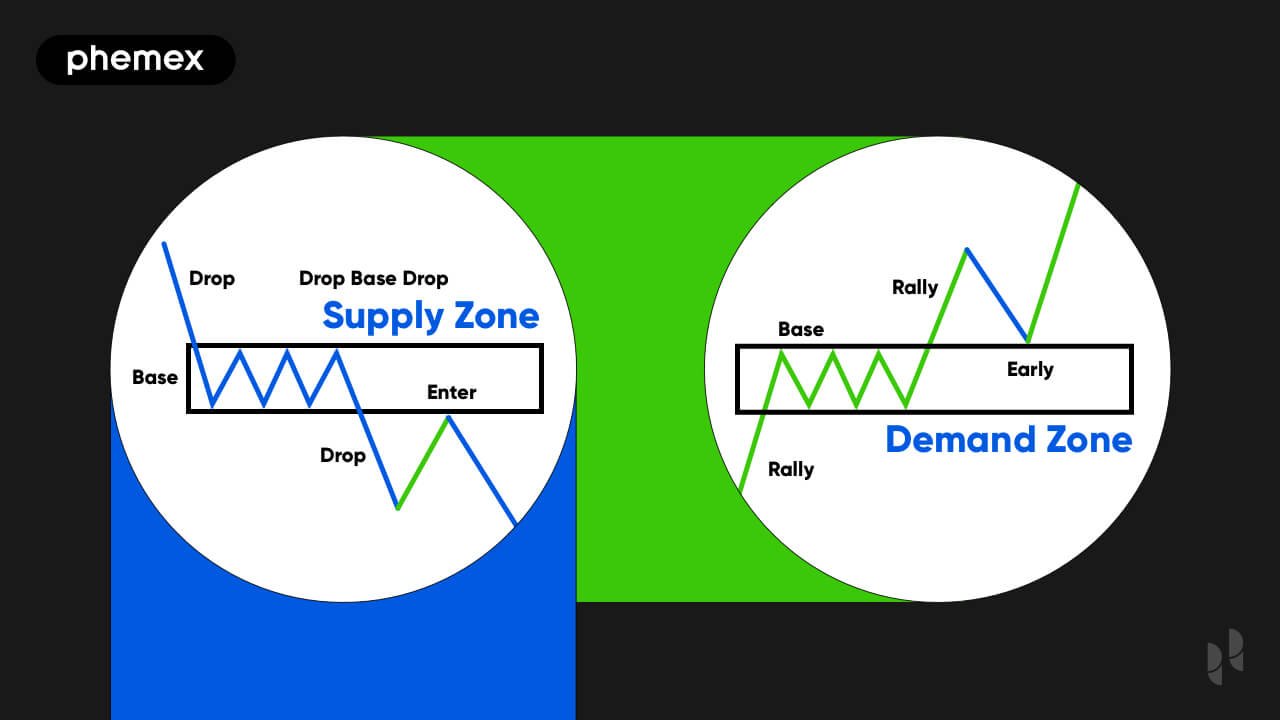

1. Market Demand and Supply

The basic economic principle of supply and demand plays a significant role in determining the value of cryptocurrencies.

- Demand: Increased interest from investors, institutional adoption, and real-world use cases can drive demand.

- Supply: The total supply of a cryptocurrency, including its issuance rate and maximum supply, affects its value. For example, Bitcoin’s capped supply of 21 million coins contributes to its scarcity and value.

2. Technological Developments

Technological advancements and updates can significantly impact a cryptocurrency’s value.

- Blockchain Upgrades: Improvements in blockchain technology, such as Ethereum’s transition to Ethereum 2.0, can enhance scalability and security, boosting value.

- Smart Contracts: The ability to execute smart contracts can increase a cryptocurrency’s utility and demand.

- Interoperability: Cryptocurrencies that can interact with other blockchains and systems may see increased adoption and value.

3. Regulatory Environment

Regulations and government policies can have a profound impact on the value of cryptocurrencies.

- Positive Regulations: Clear and supportive regulations can boost investor confidence and adoption.

- Negative Regulations: Bans or restrictive policies can lead to market uncertainty and price drops.

- Global Coordination: International regulatory cooperation can create a more stable environment for crypto growth.

4. Market Sentiment

Market sentiment, driven by news, social media, and investor behavior, can cause significant price fluctuations.

- Positive News: Announcements of partnerships, technological breakthroughs, or institutional investments can drive prices up.

- Negative News: Security breaches, regulatory crackdowns, or negative media coverage can lead to price drops.

- Social Media Influence: Influencers and community discussions on platforms like Twitter and Reddit can impact market sentiment.

5. Adoption and Use Cases

The real-world adoption and use cases of a cryptocurrency can significantly influence its value.

- Merchant Acceptance: Increased acceptance by merchants and businesses can drive demand.

- Decentralized Finance (DeFi): Cryptocurrencies that power DeFi platforms can see increased utility and value.

- Non-Fungible Tokens (NFTs): The rise of NFTs has boosted the value of cryptocurrencies like Ethereum, which are used to create and trade NFTs.

6. Economic Factors

Broader economic conditions can also impact the value of cryptocurrencies.

- Inflation: Cryptocurrencies like Bitcoin are often seen as a hedge against inflation, driving demand during economic uncertainty.

- Currency Devaluation: In countries with unstable currencies, cryptocurrencies can serve as a store of value, increasing their adoption and value.

- Interest Rates: Changes in interest rates can influence investor behavior and the attractiveness of cryptocurrencies as an investment.

7. Network Security and Stability

The security and stability of a cryptocurrency’s network are crucial for maintaining its value.

- Hash Rate: A higher hash rate indicates a more secure network, increasing investor confidence.

- Network Upgrades: Regular updates and improvements can enhance network stability and security.

- Community Support: A strong and active community can contribute to the network’s resilience and growth.

8. Competition

The competitive landscape can impact the value of individual cryptocurrencies.

- New Entrants: The emergence of new cryptocurrencies with innovative features can affect the value of existing ones.

- Market Share: Cryptocurrencies that capture a significant market share can see increased value due to network effects.

- Technological Edge: Cryptocurrencies with superior technology or unique features can outperform competitors.

9. Media Coverage and Public Perception

Media coverage and public perception can significantly influence the value of cryptocurrencies.

- Positive Coverage: Favorable media coverage can boost investor confidence and drive prices up.

- Negative Coverage: Negative media coverage can lead to market panic and price drops.

- Public Perception: The general public’s perception of cryptocurrencies as a legitimate asset class can impact adoption and value.

10. Macroeconomic Trends

Global macroeconomic trends can also influence the value of cryptocurrencies.

- Geopolitical Events: Political instability and geopolitical events can drive demand for cryptocurrencies as a safe-haven asset.

- Global Economic Trends: Economic growth or recession can impact investor behavior and the attractiveness of cryptocurrencies.

- Technological Trends: Broader technological trends, such as the rise of blockchain technology, can influence the value of cryptocurrencies.

Conclusion

The value of cryptocurrencies is influenced by a complex interplay of factors, including market demand, technological developments, regulatory environment, and broader economic conditions. By understanding these factors, you can make more informed investment decisions and navigate the volatile crypto market effectively. Stay informed, conduct thorough research, and consider the broader context when evaluating the potential value of a cryptocurrency.