How to Safely Participate in ICOs and IDOs: A Step-by-Step Guide

Learn how to safely participate in ICOs and IDOs with this comprehensive guide. Discover tips, risks, and best practices for investing in crypto projects.

How to Safely Participate in ICOs and IDOs: A Step-by-Step Guide

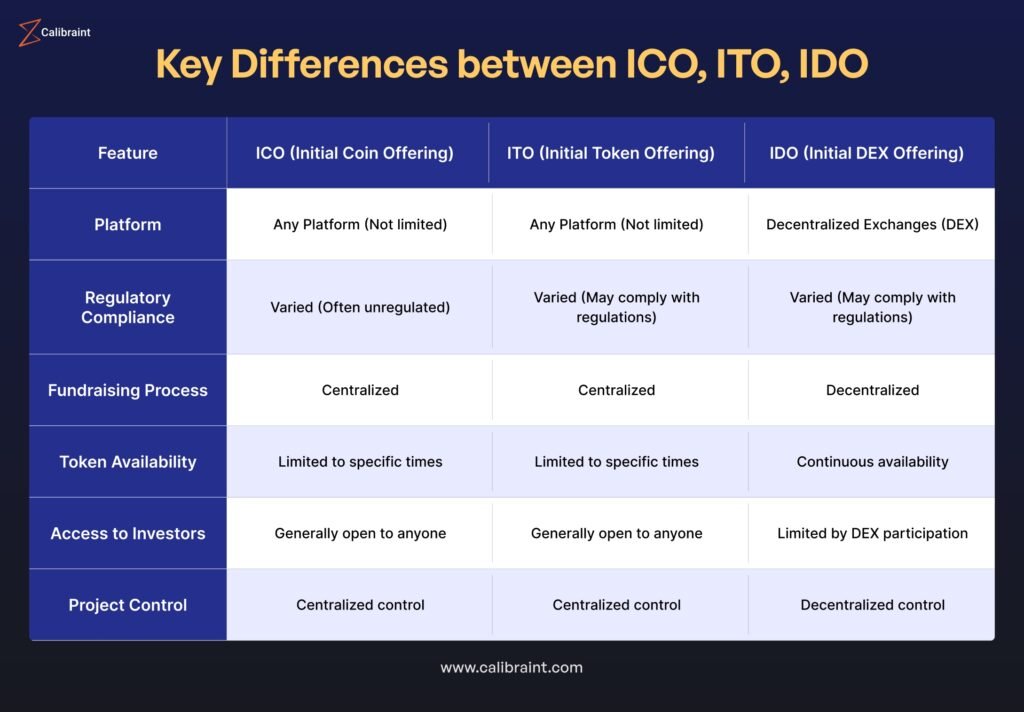

Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs) are popular ways to invest in new cryptocurrency projects. However, they come with significant risks, including scams and market volatility. In this guide, we’ll walk you through the steps to safely participate in ICOs and IDOs, helping you make informed investment decisions.

What are ICOs and IDOs?

- ICO (Initial Coin Offering): A fundraising method where new cryptocurrencies are sold to investors before being listed on exchanges.

- IDO (Initial DEX Offering): A fundraising method conducted on decentralized exchanges (DEXs), offering immediate liquidity and trading.

Step 1: Research the Project

Thorough research is crucial before investing in any ICO or IDO. Here’s what to look for:

- Whitepaper: Read the project’s whitepaper to understand its goals, technology, and roadmap.

- Team: Investigate the team’s background and experience.

- Use Case: Assess the project’s real-world applications and potential impact.

- Community: Check the project’s social media channels and community engagement.

Step 2: Evaluate the Tokenomics

Understanding the tokenomics of the project is essential. Key factors to consider include:

- Token Supply: Total number of tokens and their distribution.

- Utility: How the token will be used within the ecosystem.

- Vesting Period: Lock-up periods for team and advisor tokens.

Step 3: Choose a Reputable Platform

Select a reputable platform to participate in the ICO or IDO. Some popular platforms include:

- ICOs: Websites like ICO Bench and ICO Drops list upcoming ICOs.

- IDOs: Platforms like Polkastarter, DAO Maker, and Balancer host IDOs.

Step 4: Secure Your Wallet

Ensure you have a secure wallet to store your tokens. Options include:

- Hardware Wallets: Ledger, Trezor

- Software Wallets: MetaMask, Trust Wallet

Step 5: Participate in the Sale

Follow these steps to participate in the ICO or IDO:

- Register: Sign up on the project’s website or platform.

- KYC/AML: Complete any required identity verification processes.

- Fund Your Wallet: Transfer the required cryptocurrency (e.g., ETH, BNB) to your wallet.

- Contribute: Follow the instructions to contribute funds and receive tokens.

Step 6: Monitor Your Investment

After participating, keep an eye on the project’s progress and market performance. Key actions include:

- Track Developments: Follow updates from the project team.

- Market Performance: Monitor the token’s price and trading volume.

- Community Engagement: Stay active in the project’s community for the latest news.

Tips for Safe Participation

- Avoid Scams: Be cautious of projects with unrealistic promises or lack of transparency.

- Diversify: Don’t invest all your funds in a single ICO or IDO.

- Stay Informed: Keep up with the latest trends and news in the crypto space.

- Secure Your Investments: Use strong passwords, enable 2FA, and store your private keys securely.

Common Mistakes to Avoid

- Ignoring Research: Failing to research the project thoroughly can lead to poor investment decisions.

- Overinvesting: Avoid investing more than you can afford to lose.

- Neglecting Security: Failing to secure your wallet and private keys can result in significant losses.

Conclusion

Participating in ICOs and IDOs can be a rewarding way to invest in new cryptocurrency projects, but it comes with risks. By conducting thorough research, choosing reputable platforms, and securing your investments, you can navigate the ICO and IDO landscape safely. Remember to stay informed, diversify your portfolio, and invest responsibly.