Bitcoin vs. Gold: Which is the Better Investment?

Compare Bitcoin and gold as investment options. Discover the pros and cons of each, and learn which asset might be the better choice for your portfolio.

Bitcoin vs. Gold: Which is the Better Investment?

When it comes to investing, both Bitcoin and gold have captured the attention of investors worldwide. While gold has been a store of value for centuries, Bitcoin is a relatively new asset that has gained significant popularity in recent years. But which is the better investment? In this article, we’ll compare Bitcoin and gold, exploring their similarities, differences, and potential as investment options.

What is Bitcoin?

Bitcoin is a decentralized digital currency created in 2009 by an anonymous person or group known as Satoshi Nakamoto. It operates on a technology called blockchain, which ensures transparency and security. Bitcoin is often referred to as “digital gold” due to its limited supply of 21 million coins.

What is Gold?

Gold is a precious metal that has been used as a store of value and medium of exchange for thousands of years. It is prized for its rarity, durability, and intrinsic value. Gold is often seen as a safe-haven asset, especially during times of economic uncertainty.

Bitcoin vs. Gold: Key Differences

| Aspect | Bitcoin | Gold |

|---|---|---|

| Form | Digital currency | Physical metal |

| Supply | Limited to 21 million coins | Finite, but new gold is mined regularly |

| Storage | Digital wallets | Physical storage (vaults, safes) |

| Portability | Highly portable (can be sent globally) | Less portable (requires physical transport) |

| Volatility | Highly volatile | Relatively stable |

| Accessibility | Accessible to anyone with an internet connection | Requires physical access or financial intermediaries |

Advantages of Bitcoin

- High Growth Potential: Bitcoin has shown significant price appreciation since its inception, making it attractive for investors seeking high returns.

- Decentralization: Bitcoin operates without a central authority, reducing the risk of government interference.

- Liquidity: Bitcoin can be easily bought, sold, and transferred globally.

- Scarcity: With a fixed supply, Bitcoin is inherently deflationary.

Advantages of Gold

- Stability: Gold has a long history of maintaining its value, especially during economic downturns.

- Tangibility: Gold is a physical asset, which some investors prefer over digital assets.

- Inflation Hedge: Gold is often seen as a hedge against inflation and currency devaluation.

- Universal Acceptance: Gold is recognized and valued worldwide.

Risks of Bitcoin

- Volatility: Bitcoin’s price can be highly volatile, leading to significant gains or losses.

- Regulatory Uncertainty: Governments around the world are still figuring out how to regulate Bitcoin, which could impact its future.

- Security Risks: While Bitcoin itself is secure, exchanges and wallets can be vulnerable to hacks.

Risks of Gold

- Storage Costs: Storing physical gold can be expensive and requires secure facilities.

- Liquidity: While gold is liquid, selling physical gold can be more cumbersome than selling Bitcoin.

- No Passive Income: Gold does not generate interest or dividends, unlike some other investments.

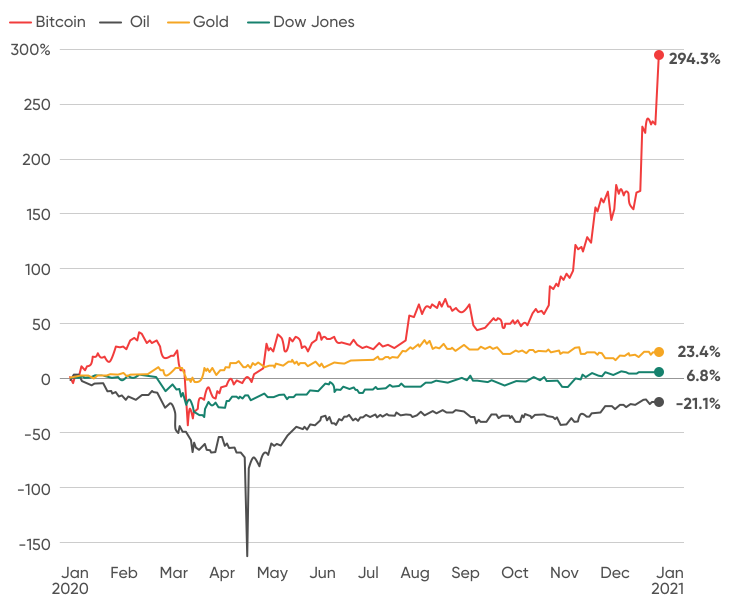

Bitcoin vs. Gold: Historical Performance

- Bitcoin: Since its creation in 2009, Bitcoin has seen exponential growth, with its price increasing from less than 1toover60,000 at its peak in 2021. However, it has also experienced significant price drops.

- Gold: Gold has shown steady growth over the long term, with its price increasing from around 35perounceinthe1970stoover1,900 in 2023. It is less volatile compared to Bitcoin.

Which is the Better Investment?

The choice between Bitcoin and gold depends on your investment goals, risk tolerance, and time horizon:

- Choose Bitcoin if:

- You’re looking for high growth potential.

- You’re comfortable with high volatility and risk.

- You prefer a digital, decentralized asset.

- Choose Gold if:

- You want a stable, time-tested store of value.

- You prefer a physical asset with lower volatility.

- You’re looking for a hedge against inflation and economic uncertainty.

Diversification: The Best of Both Worlds

Many investors choose to diversify their portfolios by holding both Bitcoin and gold. This approach allows you to benefit from the growth potential of Bitcoin while maintaining the stability and security of gold.

Conclusion

Both Bitcoin and gold have unique advantages and risks as investment options. Bitcoin offers high growth potential and decentralization, while gold provides stability and a proven track record. By understanding the differences and considering your investment goals, you can make an informed decision about which asset is right for you.