What is Bitcoin Halving and How Does It Affect Bitcoin’s Price?

Discover what Bitcoin Halving is, how it works, and its impact on Bitcoin’s price. Learn why this event is crucial for investors and the crypto market.

What is Bitcoin Halving and How Does It Affect Bitcoin’s Price?

Bitcoin Halving is one of the most anticipated events in the cryptocurrency world. It plays a significant role in Bitcoin’s economics and has historically influenced its price. But what exactly is Bitcoin Halving, and why does it matter? In this article, we’ll explore the concept of Bitcoin Halving, its purpose, and how it impacts Bitcoin’s price.

What is Bitcoin Halving?

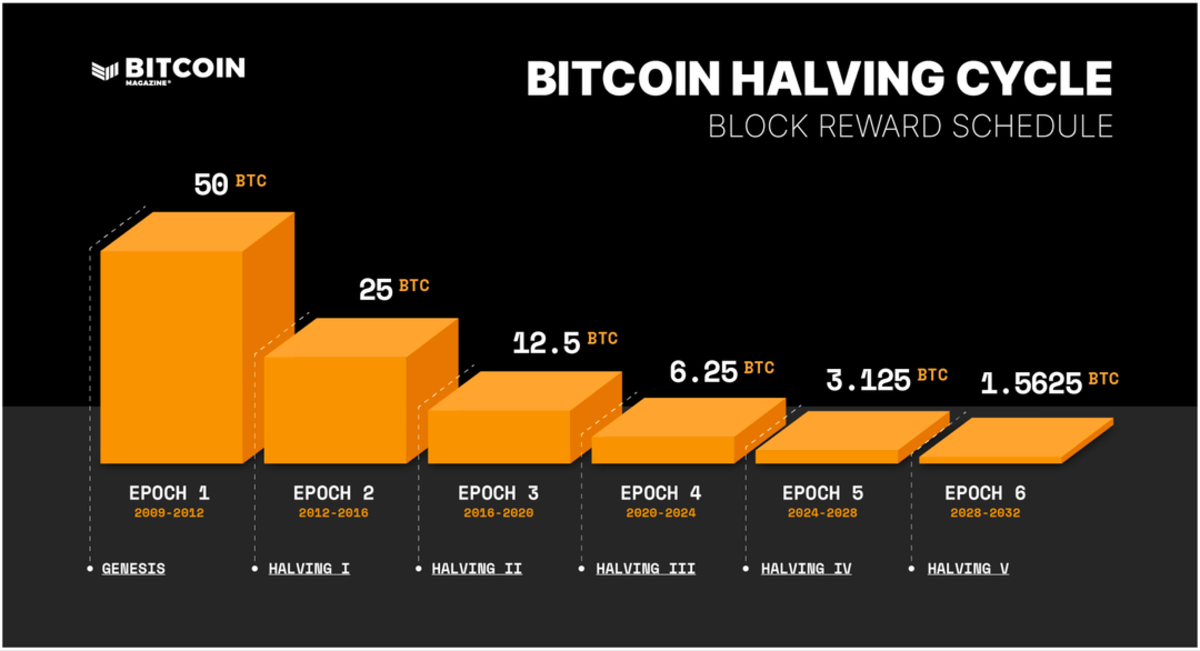

Bitcoin Halving is a pre-programmed event that occurs approximately every four years or after every 210,000 blocks are mined. During this event, the reward that Bitcoin miners receive for validating transactions and adding new blocks to the blockchain is cut in half. This process is built into Bitcoin’s code by its creator, Satoshi Nakamoto, to control the supply of Bitcoin and ensure its scarcity.

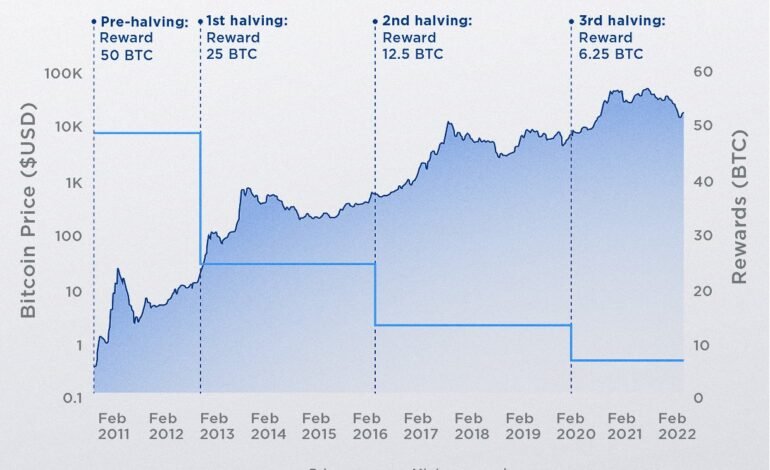

The initial block reward in 2009 was 50 BTC. After three halvings, the current block reward (as of 2023) is 6.25 BTC. The next Bitcoin Halving is expected to occur in 2024, reducing the reward to 3.125 BTC.

Why Does Bitcoin Halving Happen?

Bitcoin Halving serves two main purposes:

- Control Inflation: By reducing the rate at which new Bitcoins are created, halving ensures that Bitcoin remains a deflationary asset. This contrasts with fiat currencies, which can be printed endlessly, leading to inflation.

- Mimic Precious Metals: Bitcoin’s design mimics the scarcity of precious metals like gold. The halving mechanism ensures that the total supply of Bitcoin will never exceed 21 million coins.

How Does Bitcoin Halving Affect Price?

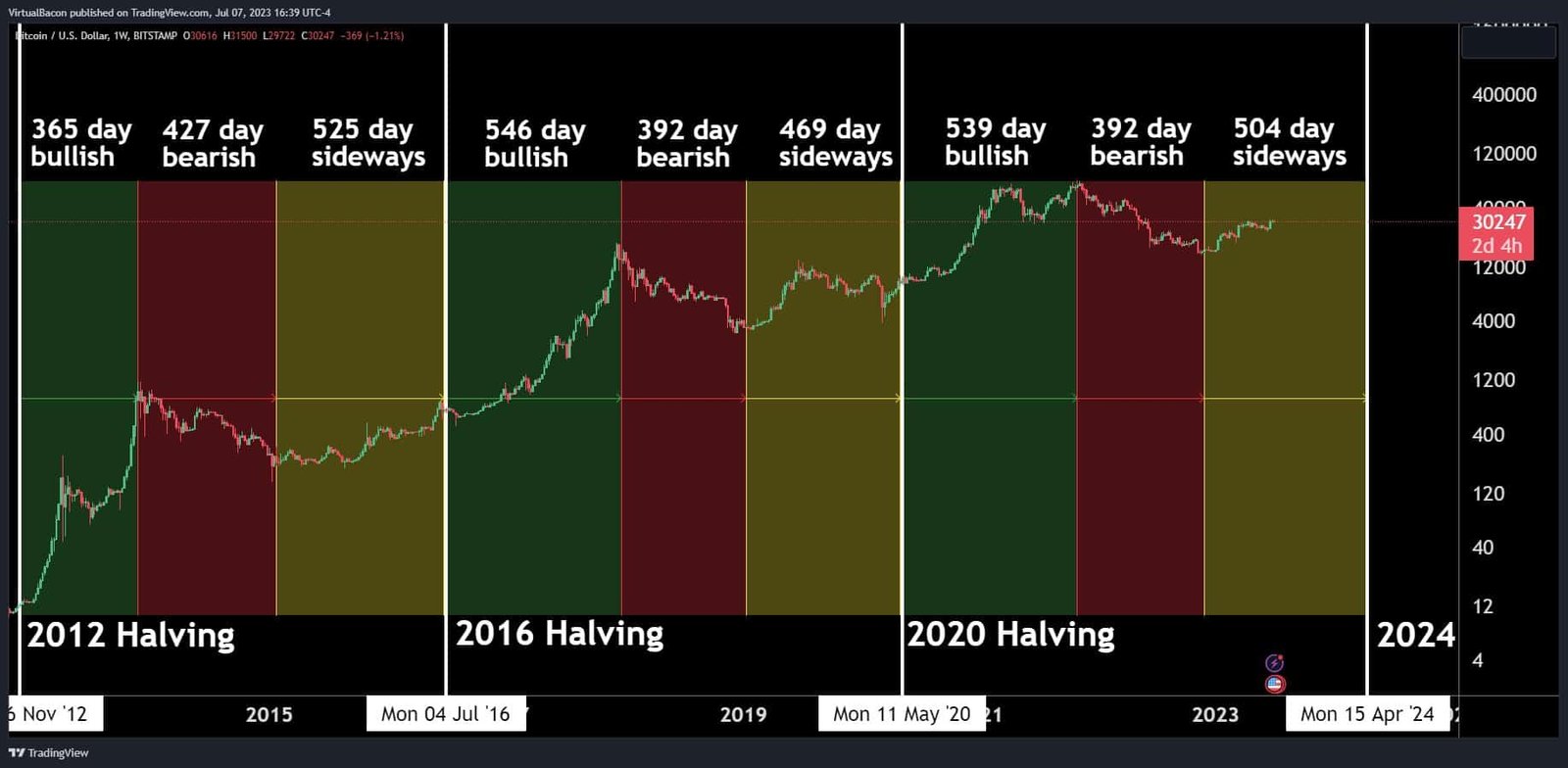

Bitcoin Halving has historically had a significant impact on Bitcoin’s price. Here’s how it works:

- Reduced Supply: Halving cuts the supply of new Bitcoins entering the market. If demand remains constant or increases, the reduced supply can lead to higher prices.

- Increased Scarcity: As Bitcoin becomes scarcer, its perceived value often increases, attracting more investors.

- Market Sentiment: Halving events generate significant media attention and hype, which can drive speculative buying and price surges.

Historical Impact of Bitcoin Halving

Let’s take a look at how previous Bitcoin Halvings have affected the price:

1. First Halving (2012)

- Block Reward: Reduced from 50 BTC to 25 BTC.

- Price Before Halving: Around $12.

- Price One Year Later: Over $1,000.

2. Second Halving (2016)

- Block Reward: Reduced from 25 BTC to 12.5 BTC.

- Price Before Halving: Around $650.

- Price One Year Later: Nearly $2,500.

3. Third Halving (2020)

- Block Reward: Reduced from 12.5 BTC to 6.25 BTC.

- Price Before Halving: Around $8,500.

- Price One Year Later: Over $60,000.

What to Expect from the 2024 Bitcoin Halving

The next Bitcoin Halving is expected to occur in 2024. While past performance is not a guarantee of future results, many analysts predict that the 2024 halving could have a similar impact on Bitcoin’s price. Factors to consider include:

- Increased Institutional Adoption: More institutions are investing in Bitcoin, which could amplify the effects of reduced supply.

- Global Economic Conditions: Economic uncertainty and inflation could drive more investors toward Bitcoin as a store of value.

- Technological Developments: Improvements in Bitcoin’s technology, such as the Lightning Network, could increase its utility and demand.

How to Prepare for Bitcoin Halving

If you’re an investor or crypto enthusiast, here’s how you can prepare for the next Bitcoin Halving:

- Educate Yourself: Understand the mechanics and implications of Bitcoin Halving.

- Diversify Your Portfolio: Don’t put all your funds into Bitcoin. Consider diversifying with other cryptocurrencies or assets.

- Monitor Market Trends: Keep an eye on market sentiment and news leading up to the halving.

- Secure Your Bitcoin: Use a secure wallet to store your Bitcoin and protect your investment.

Conclusion

Bitcoin Halving is a fundamental event that underscores Bitcoin’s scarcity and deflationary nature. By reducing the supply of new Bitcoins, halving events have historically driven significant price increases. As the next halving approaches in 2024, understanding its impact can help you make informed investment decisions.