The Effect of Cyberattacks on Cryptocurrency Markets

Understanding Cyberattacks: An Overview

Cyberattacks are deliberate attempts to breach the security of a computer system, network, or digital device, often with malicious intent. These attacks can vary widely in their methods and objectives, and they pose significant risks to various sectors, including financial markets. In the realm of cryptocurrency, cyberattacks can disrupt operations, compromise security, and cause substantial financial losses. Among the most common types of cyberattacks affecting cryptocurrency platforms are phishing, distributed denial-of-service (DDoS), and ransomware.

Phishing attacks involve deceiving individuals into revealing sensitive information, such as private keys or login credentials, by masquerading as a trustworthy entity. In the context of crypto gaming and blockchain games, these attacks can lead to unauthorized access to wallets, resulting in the theft of cryptocurrency or NFTs. DDoS attacks overwhelm a server with traffic to render it inoperable, a strategy that can undermine the availability of platforms used for trading cryptocurrency or participating in NFT games. These attacks not only disrupt user access but can also tarnish the reputation of affected platforms.

Ransomware attacks are particularly concerning, as they encrypt data and demand payment, typically in cryptocurrency, for decryption keys. These attacks particularly target exchanges and payment processors which are vital for crypto transactions. High-profile incidents have showcased the vulnerabilities present in the crypto space. For example, a major exchange was targeted by a DDoS attack that made its services inaccessible for hours, causing panic among users and a temporary drop in cryptocurrency prices. Understanding these methodologies and their consequences is crucial for stakeholders in the cryptocurrency market to mitigate risks associated with cyber threats, as they can significantly impact the evolving landscape of crypto gaming and the broader adoption of blockchain technologies.

Impact on Cryptocurrency Prices and Volatility

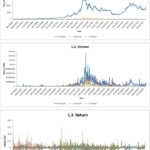

Cyberattacks have a profound impact on the cryptocurrency markets, often leading to significant fluctuations in prices and increased volatility. The decentralized nature of blockchain games and other crypto gaming platforms means that they are not exempt from vulnerabilities. For instance, high-profile breaches have resulted in immediate and drastic reactions from both investors and traders alike, causing ripple effects throughout the entire market. When a cyberattack occurs, it can lead to immediate price drops, as seen in several notable case studies, such as the Coincheck hack in 2018 and the KuCoin breach in 2020.

These incidents often trigger panic selling among investors, driven by fears of losses and an erosion of trust in the affected cryptocurrencies. As the breaches elicit widespread media coverage, the fear of further attacks creates a sentiment of uncertainty, resulting in even more volatility. The psychological aspects of market reactions cannot be overlooked, as investor confidence can diminish rapidly following a notable hack. It is essential to consider how the collective mood of the market shifts post-incident, often leading to an extended period of decreased confidence in not only the affected assets, but in the entire crypto ecosystem, including blockchain games and NFT games.

The fallout from cyberattacks can extend beyond immediate price drops. It can lead to longer-term implications as investors begin to reassess the security measures of various platforms. As trust becomes a pivotal factor in the adoption of cryptocurrency, incidents of hacking can restrict the growth of crypto gaming initiatives and diminish investor participation in the market. Overall, the relationship between cyberattacks and cryptocurrency prices encapsulates a complex interplay of market dynamics, psychology, and investor behavior, underscoring the sensitive nature of this rapidly evolving sector.

Consequences for Exchanges and Investors

Cyberattacks on cryptocurrency exchanges have far-reaching consequences that extend beyond mere financial losses. Every breach not only jeopardizes the immediate security of the platform but can also result in significant operational disruptions. When a cryptocurrency exchange is attacked, transactions may be halted or delayed, leading to a loss of confidence among users. This disruption manifests in decreased trading volumes, as traders become wary of the platform’s reliability, ultimately affecting market liquidity.

The reputational damage experienced by exchanges following a cyberattack can be dire. As trust is a cornerstone of the crypto ecosystem, affected exchanges often find themselves struggling to regain user confidence. News of breaches spreads quickly in the digital age, and negative publicity can linger, convincing potential investors to seek alternative platforms. Additionally, the fear of future attacks compels many exchanges to invest heavily in cybersecurity measures to reassure their users. This often translates to increased operational costs, potentially lowering profit margins.

For investors, the consequences of cyberattacks are profound. The immediate risk involves the possibility of losing funds, which can occur if an exchange is compromised. Such losses can lead to a shift in investment strategies, with many investors opting for diversified holdings or moving to platforms perceived as more secure. The aftermath of an attack can lead individuals to reconsider their engagement with blockchain games and NFT games, as concerns regarding the safety of their digital assets become paramount. Consequently, these shifts can reshape the landscape of crypto gaming, as investors become more cautious, weighing the risks associated with investing in cryptocurrency-related ventures.

In summary, the implications of cyberattacks on cryptocurrency exchanges extend beyond immediate financial impacts, affecting operational integrity, investor confidence, and the overall viability of crypto gaming initiatives amidst growing concerns about digital security.

Protective Measures and Future Outlook

As the landscape of cryptocurrency markets evolves, the necessity for robust protective measures against cyberattacks becomes paramount. The industry has seen a staggering increase in incidents targeting exchanges and wallets, prompting stakeholders to adopt proactive strategies. One of the primary solutions lies in the implementation of stronger security protocols. Exchanges must employ multifactor authentication, advanced encryption techniques, and regular security audits to protect user information and assets. Additionally, educating users on safe trading practices, such as recognizing phishing attempts and using secure wallets, can significantly minimize risks associated with cyber threats.

Furthermore, technology plays a critical role in enhancing security in the cryptocurrency space. Blockchain technology itself provides a transparent and immutable ledger that can help trace unauthorized transactions and improve trust among users. Innovations in cybersecurity, specifically tailored for crypto gaming and blockchain games, are emerging as valuable resources. These technologies help identify potential vulnerabilities in real-time, enabling exchanges to respond to threats before they escalate. By adopting such technologies, the overall resilience of the cryptocurrency markets can be improved against cyberattacks.

As we look to the future, the cryptocurrency industry must remain vigilant in the face of ongoing cyber threats. Regulatory agencies globally may take a more active role in enforcing standards for cybersecurity in crypto markets, thereby prompting exchanges to comply with stricter guidelines. This could lead to a more secure trading environment and improved confidence among users in the safety of their assets. Additionally, trends such as the growing interest in NFT games and decentralized finance (DeFi) may also shape the security landscape, fostering an environment where innovation in protective measures can thrive, ensuring continued growth and stability in the cryptocurrency sector. In conclusion, by staying ahead of cyber threats through education, technology, and regulatory frameworks, the cryptocurrency markets can not only survive but potentially flourish in an ever-evolving digital world.