Crypto Debit Cards: What They Are and How to Use Them

Cryptocurrency has revolutionized finance, yet spending it in daily life remains a challenge. Crypto debit cards have emerged as a solution, offering users the ability to utilize their crypto holdings for purchases by converting them into fiat currencies at the time of payment. This innovation connects blockchain-based finance with the traditional financial world, making cryptocurrency more accessible for everyday transactions.

These cards function similarly to traditional debit cards, enabling online shopping, dining, and other transactions. They combine the global usability of established payment networks like Visa and Mastercard with the unique advantages of cryptocurrency.

Let’s explore what crypto debit cards are, how they operate, and the benefits they bring.

What Are Crypto Debit Cards?

Crypto debit cards are payment tools that let you spend cryptocurrencies such as Bitcoin or Ethereum directly from your digital wallet. These cards, issued in collaboration with major payment processors, remove the need for manually converting crypto into fiat currency before making purchases.

Whether you’re shopping online, paying at physical stores, or withdrawing cash from ATMs, these cards streamline transactions. Additionally, some cards offer rewards like cashback or cryptocurrency incentives, making them attractive to users who frequently transact.

Despite their advantages, crypto debit cards share vulnerabilities with traditional payment cards. Ensuring the security of your card details and wallet is crucial to prevent fraud.

How Crypto Debit Cards Work

A crypto debit card operates much like a standard debit card but links to your cryptocurrency wallet instead of a bank account. When you use the card, the system converts cryptocurrency into fiat currency in real time, enabling you to make payments at merchants worldwide. The entire process is seamless, and merchants often don’t even realize you’re using cryptocurrency.

For example:

- You swipe your crypto debit card for a purchase.

- The linked payment processor instantly converts the equivalent crypto amount into fiat.

- The merchant receives payment in their local currency.

This process allows crypto holders to navigate a world where direct crypto payments might not yet be accepted.

Debit vs. Credit: What’s the Difference?

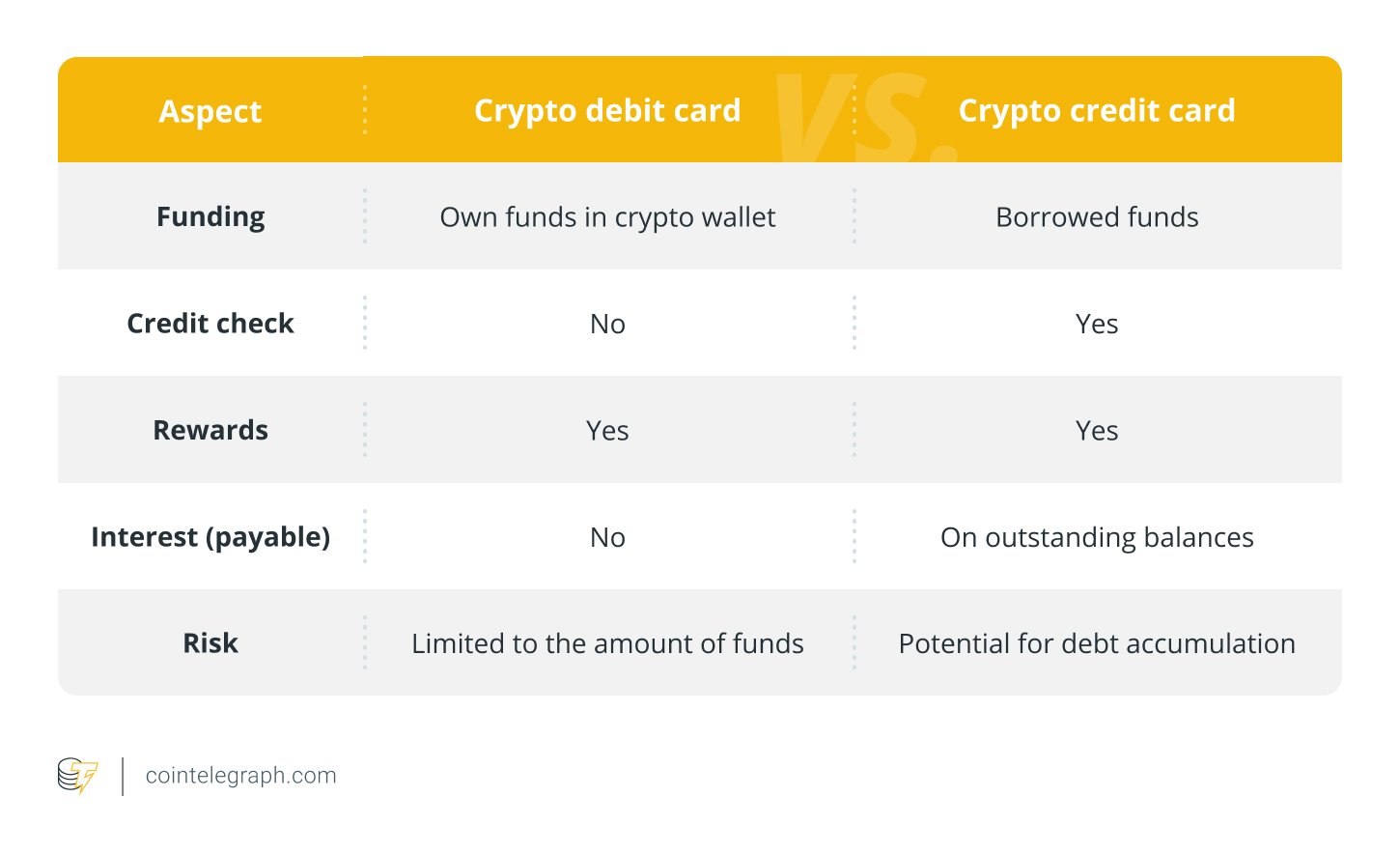

Crypto cards come in two varieties: debit and credit, each suited to different user needs.

Crypto Debit Cards

- Function like prepaid cards, requiring you to fund them with cryptocurrency.

- Charge fees for maintenance, withdrawals, and currency conversions.

- Offer benefits like cashback rewards or rebates on services.

- Limited to the balance in your wallet, making them ideal for controlled spending.

Crypto Credit Cards

- Work like traditional credit cards, allowing deferred payments.

- Offer rewards, often in cryptocurrencies, for purchases.

- May include annual fees, interest charges, or late payment penalties.

- Affect your credit score, making responsible usage critical.

Getting Started with Crypto Debit Cards

Ready to use a crypto debit card? Here’s how you can begin:

- Choose a Provider: Research platforms like Binance, Coinbase, or Crypto.com. Compare their fees, supported cryptocurrencies, and perks.

- Create an Account: Sign up with your chosen platform and complete the necessary identity verification (KYC).

- Fund Your Wallet: Deposit cryptocurrency into your account. Some providers may require staking certain tokens to unlock additional benefits.

- Order Your Card: Request a virtual or physical card, depending on your preference.

- Activate and Use: Activate your card and start spending, either online or at physical stores.

Choosing the Right Card

When selecting a crypto debit card, consider the following factors:

- Fees: Check for transaction and withdrawal charges.

- Supported Cryptocurrencies: Ensure compatibility with your preferred coins.

- Global Acceptance: Opt for cards linked to major networks for widespread usability.

- Rewards: Look for cashback, discounts, or cryptocurrency incentives.

- Security Features: Prioritize cards with robust security measures like two-factor authentication (2FA).

Advantages and Challenges

Key Benefits

- Simplified spending of crypto without manual conversions.

- Real-time transactions backed by global payment networks.

- Enhanced security through features like virtual cards and transaction alerts.

- Incentives like cashback in cryptocurrencies or exclusive perks.

Potential Challenges

- Vulnerability to hacking and fraud.

- Evolving regulatory environments may impact usability.

- High conversion fees with some providers.

- Tax implications, as each transaction can be a taxable event.

The Future of Crypto Debit Cards

As cryptocurrencies integrate further into mainstream finance, the future of crypto debit cards looks promising. Advancements may include:

- Improved Security: Biometric authentication and AI-driven fraud prevention.

- Broader Acceptance: More merchants embracing crypto payments.

- Enhanced Rewards: Competitive perks such as higher cashback rates or premium services.

- Regulatory Clarity: Simplified compliance, boosting user confidence.

In addition, cards may offer seamless integration with diverse wallets and blockchain networks, providing unparalleled flexibility.

Crypto debit cards are reshaping how cryptocurrencies are used in everyday life. With their growing acceptance and evolving features, these cards are poised to play a significant role in the financial future. By choosing the right provider and understanding the associated responsibilities, you can make the most of this innovative payment solution.