Bitcoin Halving: How Does It Affect Bitcoin’s Value?

Understanding Bitcoin Halving

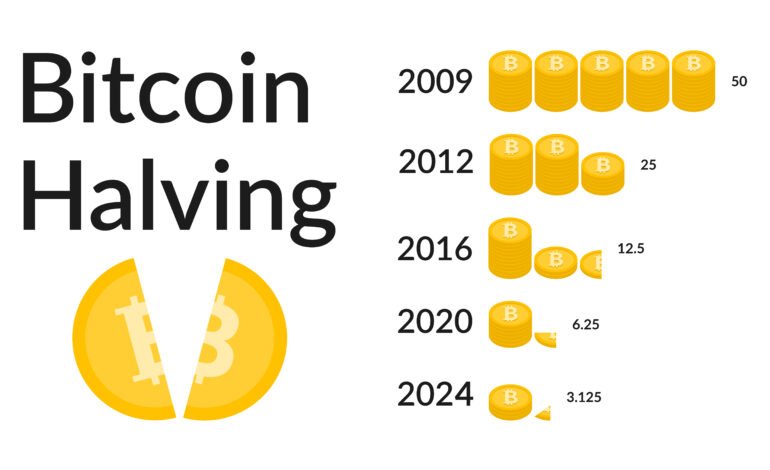

nBitcoin halving is a significant event in the cryptocurrency domain, representing a systematic reduction in the rewards given to Bitcoin miners. This mechanism is programmed into the Bitcoin protocol to occur every 210,000 blocks mined, roughly every four years. During a halving event, the reward for mining new blocks is cut in half, which effectively decreases the rate at which new bitcoins are created. This deflationary characteristic is pivotal as it helps to regulate the total supply of Bitcoin, which is capped at 21 million coins.nnThe importance of halving lies in its dual impact on the mining community and the economics of Bitcoin itself. Initially, miners received 50 bitcoins per block when the Bitcoin network launched in 2009. This reward has been halved twice since then, first to 25 bitcoins in 2012, then to 12.5 in 2016, and most recently to 6.25 bitcoins in 2020. Each halving event is anticipated with considerable attention, as it influences the dynamics of supply and demand for bitcoins. The reduced issuance of new bitcoins typically leads to increased scarcity, which, according to economic principles, can bolster demand and potentially elevate the value of Bitcoin in the market.nnHistorically, Bitcoin halvings have generated substantial interest, with previous events often correlating with price surges in the months following the halving. The cryptocurrency community closely monitors these occurrences, as they signify notable shifts in the ecosystem. Halving is a built-in feature that ensures that Bitcoin remains a finite asset, contributing to its appeal as a store of value in contrast to traditional fiat currencies, which can be printed without limit. This scarcity principle underlines the significance of halving events, making them pivotal moments for stakeholders within the cryptocurrency market.n

The Historical Impact of Halving on Bitcoin’s Price

Bitcoin halving events have historically played a significant role in influencing the cryptocurrency’s price. These events, which reduce the reward for mining new blocks by half, occur approximately every four years. The halvings have historically been linked to notable price movements, with each event featuring its own unique market dynamics.nnIn November 2012, Bitcoin underwent its first halving, which reduced mining rewards from 50 BTC to 25 BTC. Leading up to this event, the price surged from approximately $2 to around $12. Post-halving, there was significant bullish sentiment, with Bitcoin reaching peaks near $1,100 by the end of 2013. Investor speculation and heightened interest in cryptocurrencies contributed to this explosive growth.nnSimilarly, the 2016 halving saw Bitcoin’s block reward decline from 25 BTC to 12.5 BTC. Prior to this event, the price rallied from $400 in early 2016, peaking at nearly $20,000 in December 2017. The combination of a shrinking supply and increasing demand changed market sentiment, reinforcing Bitcoin’s value as a digital asset. The period was marked by intense speculation, driven largely by media coverage and retail investor participation.nnThe 2020 halving further reinforced these patterns, with Bitcoin’s reward decreasing from 12.5 BTC to 6.25 BTC. Leading up to this halving, Bitcoin experienced a price consolidation between $8,000 and $10,000. However, post-halving, the coin’s value surged, reaching around $64,000 in April 2021. This period highlighted the influence of macroeconomic factors, including institutional adoption and growing acceptance of Bitcoin as a hedge against inflation.nnWhile past halvings have shown a tendency for increased prices in subsequent months, it is critical to note that historical patterns are not guaranteed indicators of future price movements. Market conditions, investor sentiment, and macroeconomic factors can vary significantly, posing challenges in predicting Bitcoin’s future value post-halving.n

Future Projections: What to Expect from the Upcoming Halving

nThe forthcoming Bitcoin halving event is anticipated to have significant implications for the cryptocurrency’s value. Historically, halving events have led to remarkable price increases, as they reduce the block reward for miners and thus the rate at which new bitcoins are circulated. Consequently, a reduced supply often leads to an increase in demand, driving prices upward. Expert opinions vary, but many analysts are projecting bullish trends post-halving, emphasizing the potential for heightened interest from both retail and institutional investors. Some institutions are increasingly viewing Bitcoin as a hedge against inflation, which may further amplify its appeal following the upcoming event.nnMarket predictions suggest that the reduced supply, in conjunction with growing institutional interest, could create a perfect storm for bullish price action. As supply diminishes and demand potentially rises, the fundamental dynamics of Bitcoin’s market could see notable shifts. However, caution is warranted, as some analysts also foresee a possible bearish phase, particularly if market sentiment does not shift as anticipated. Wider economic factors, such as regulations affecting cryptocurrencies or downturns in the global economy, may also play crucial roles in shaping Bitcoin’s price trajectory.nnThe psychological impact of halving on investor behavior cannot be dismissed either. Historically, these events have led to increased speculation and FOMO (fear of missing out), often resulting in price peaks shortly after the halving. However, this excitement can also lead to volatility. As traders react to market shifts, understanding these psychological dynamics is key to making informed investment decisions. Looking ahead, by carefully monitoring both market movements and sentiment, investors can better navigate the uncertainties surrounding Bitcoin’s value in the post-halving landscape.